Soteria Biotherapeutics Launches with $42 Million Series A Financing Led by Roche Venture Fund and 5AM Ventures

SAN FRANCISCO, May 17, 2021: Soteria Biotherapeutics, Inc. (“Soteria”), a privately-held, immuno-oncology company focused on developing a next generation of switchable bispecific T-cell engagers to treat patients with solid tumor cancers, today announced a $42 million Series A financing led by Roche Venture Fund and 5AM Ventures with participation from other leading investors, including M Ventures, Novartis Venture Fund and Alexandria Venture Investments.

Soteria’s T-LITETM T-cell engagers are selectively switched on through oral administration of a small-molecule activator to modulate potent T-cell activity by controlling the timing, duration, and level of bispecific complex formation. This switchable activity enables precise on/off control over the timing and magnitude of T-cell redirection and cytotoxic activity. Unlike conventional T-cell engagers which lack a control switch and therefore are associated with significant side effects, Soteria’s T-LITE therapies are being designed to allow physicians to modulate T-cell activity to maximize efficacy while minimizing side effects.

“Soteria’s technology has the potential to revolutionize the T-cell engager field with its proprietary approach designed to control and target potent biologic immune activators to attack tumors,” said Nisha Marathe, investment director at Roche Venture Fund. “Specifically, we believe the T-LITE technology is highly differentiated, where the potent activity of a T-cell engager can be selectively switched on by small-molecule activators to direct tumor cytotoxicity and reduce cytokine release syndrome, ultimately resulting in a therapy with potentially greater safety and efficacy.”

“These funds will support the advancement of our technology and allow us to build a pipeline of T-LITE development candidates with potential in well validated cancer targets,” said Kristine Ball, chief executive officer of Soteria. “We appreciate the confidence and vision this syndicate of premier investors has shown in our opportunity to disrupt the T-cell engager field and our potential to create differentiated, potent therapies against solid tumors.”

Company Founders and Leadership

Soteria’s team of founders, management and board members brings together accomplished leaders from academia and the biopharma industry with successful track records discovering and developing therapeutics at companies such as Abgenix, Ascendis Pharma, AstraZeneca/Medimmune, Exelixis, Genentech/Roche, KAI (acquired by Amgen), Labrys (acquired by TEVA), Merck Research Laboratories, Novartis, Relypsa (acquired by Vifor) and Sunesis:

Kristine Ball, Chief Executive Officer and Member of the Board

Zachary Hill, PhD, Co-Founder and SVP, Chief Scientific Officer, and Member of the Board

Mohammad Tabrizi, PhD, VP Preclinical Development

Alex Martinko, PhD, Co-Founder and Senior Director of Protein Science

Jim Wells, PhD, Academic Co-founder, Chair of Scientific Advisory Board, and Professor of Pharmaceutical Chemistry at UC San Francisco

Steven P. James, Board Chair and Chief Executive Officer of Pionyr Immunotherapeutics

David Allison, PhD, Member of the Board and Partner at 5AM Ventures

Keno Gutierrez, PhD, Member of the Board and Vice President at M Ventures

Nisha Marathe, PhD, Member of the Board and Investment Director at Roche Venture Fund

David Morris, MD, Member of the Board and Operating Partner at Novartis Venture Fund

Momo Wu, PhD, Member of the Board and Portfolio Investment Manager at Emerson Collective

About Soteria Biotherapeutics Inc.

Soteria is developing a next generation of switchable bispecific T-cell engagers to treat cancer patients with solid tumors. Soteria’s highly innovative T-LITETM platform provides small molecule-dependent activation of bispecific antibody therapies, enabling safer and more efficacious treatments through pulsatile activity, reduced side effects and higher dosing. Soteria was founded in 2018 with technology licensed from UC San Francisco and is based in San Francisco, California. For additional information, visit www.soteriabiotherapeutics.com

Contacts:

Sylvia Wheeler

swheeler@wheelhouselsa.com

info@soteriabiotx.com

Alex Santos

asantos@wheelhouselsa.com

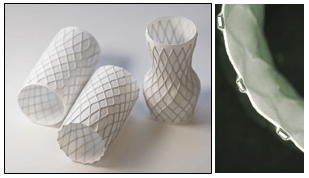

Implant designs for the fast-growing, transcatheter structural heart market primarily utilize a custom textile that is sutured to a high-performance Nitinol metal frame. Confluent’s Nitinol and biomedical textile expertise, in combination with Electrospinning’s leadership in electrospun nanofiber biomaterials expands the design options that Confluent customers can utilize in the structural heart market. Additionally, the application of the textile to the valve frame will be fully automated, simplifying the manufacturing process.

Implant designs for the fast-growing, transcatheter structural heart market primarily utilize a custom textile that is sutured to a high-performance Nitinol metal frame. Confluent’s Nitinol and biomedical textile expertise, in combination with Electrospinning’s leadership in electrospun nanofiber biomaterials expands the design options that Confluent customers can utilize in the structural heart market. Additionally, the application of the textile to the valve frame will be fully automated, simplifying the manufacturing process.