Schiphol, 28 February 2019 – SL Capital Infrastructure II (“ASI”) and DIF Core Infrastructure Fund I (“DIF”) are pleased to announce the signing of an agreement to acquire 100% of UNITANK from the family owners, with ASI and DIF each acquiring a 50% stake.

Finnish cyber security company Arctic Security closes a funding round with prominent Finnish investors to accelerate growth

FEBRUARY 28, 2019

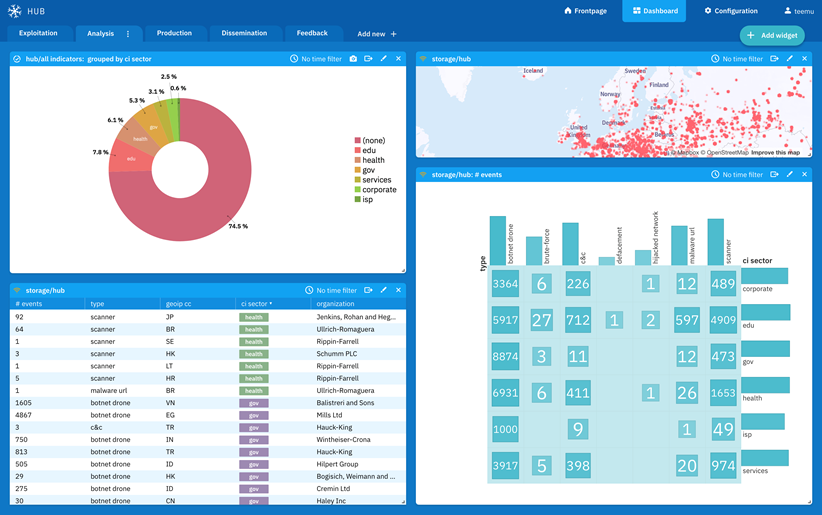

Arctic Security is proud to announce a follow-on investment to the company’s series A round by notable private entrepreneurs and investors Mikko Kodisoja, Ilkka Paananen and Georg Ehrnrooth. The new investors’ expertise in global growth companies strengthens Arctic Security’s investor base which also includes original investor CapMan Growth. The additional funds will be used to accelerate the company’s international growth in the cyber security market.

Arctic Security, established in 2017, had a very successful first year of operation, launching Arctic Hub and Arctic Node products and achieving over Euro 2,000,000 of international sales. The company’s products harmonize and categorize cyber threat information from over 100 threat intelligence feeds and then match these indicators to the actual owners of the impacted assets. This automated and intelligent correlation of the threats creates actionable data which can be used by organizations both to protect themselves in real time and to reduce future risk. Together Arctic Hub and Node deliver unparalleled scalability in integrated cyber defense from individual enterprises to multinational corporations.

“Enterprises are struggling with cyber threats and need automated solutions to integrate actionable cyber threat intelligence into their defenses. This investment will help us to bring our proven products available to a wider enterprise audience worldwide” says David Chartier CEO of Arctic Security.

About Arctic Security

Arctic Security is a company based in Oulu, Finland with offices in Helsinki, San Francisco and Singapore. The company’s devoted team is composed of international experts with extensive knowledge and experience in working in the cyber threat intelligence industry. The organization is led by CEO David Chartier, a long-term cyber security professional and the former CEO of Codenomicon.

CapMan Buyout has sold shares in Harvia Plc

CapMan Buyout X Fund A L.P and CapMan Buyout X Fund B Ky (together the “funds managed by CapMan”) have sold part of their shares in Harvia Plc (”Harvia” or the ”Company”) in an accelerated book-building to a limited number of institutional investors (the ”Share Sale”). The funds managed by CapMan sold a total of 12.3 per cent of the shares and votes in the Company. The subscription price in the Share Sale was set at EUR 6.00 per share and the gross sales proceeds amounted to approximately EUR 13.8 million. After the Share Sale, the funds managed by CapMan own 12.3 per cent of the shares in the Company.

In connection with the Share Sale, the funds managed by CapMan have entered into a lock-up undertaking, under which they have, subject to certain exceptions, agreed not to sell any shares in Harvia for a period ending May 7, 2019.

Pia Kåll, Managing Partner of CapMan Buyout, comments: “CapMan has supported Harvia through a number of important milestones and will continue with a 12.3 per cent stake. Following our investment in 2014, together with the management we developed and implemented a new growth strategy for the company, as a result of which Harvia is one of the leading sauna and spa companies in the world. This is an excellent basis for both current and new owners to continue from.”

Danske Bank A/S, Finland Branch acted as the Sole Lead Manager in the Share Sale.

Further information:

Pia Kåll, Managing Partner, CapMan Buyout, +358 207 207 555

Disclaimer

Danske Bank acted exclusively for the funds managed by CapMan and no one else and it will not regard any other person (whether or not a recipient of this release) as their respective client in relation to the Share Sale. Danske Bank will not be responsible to anyone other than the funds managed by CapMan for providing the protections afforded to their respective clients and will not give advice in relation to the Share Sale or any transaction or arrangement referred to herein. Danske Bank assumes no responsibility for the accuracy, completeness or verification of the information set forth in this release and, accordingly, disclaim, to the fullest extent permitted by applicable law, any and all liability which they may otherwise be found to have in respect of this release. Nothing contained in this release is, or shall be relied upon as, a promise or representation as to the past or the future.

The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States, Canada, New Zealand, Australia, Japan, Hong Kong, Singapore or South Africa or any other country where such publication or distribution would be unlawful. This release does not constitute an offer of securities for sale in any country. The securities mentioned herein have not been registered under the U.S. Securities Act of 1933, as amended, or the rules and regulations thereunder.

About CapMan

CapMan is a leading Nordic private asset expert with an active approach to value creation. We offer a wide selection of investment products and services. As one of the Nordic private equity pioneers, we have developed hundreds of companies and real estate assets and created substantial value in these businesses and assets over the past 30 years. CapMan employs today approximately 120 private equity professionals and has over €3 billion in assets under management. Our objective is to provide attractive returns and innovative solutions to investors. We have a broad presence in the unlisted market through our local and specialised teams. Our investment strategies cover Private Equity, Real Estate and Infra. We also have a growing service business that currently includes procurement services, fundraising advisory and fund management services. www.capman.com

Platinum Equity Completes Acquisition of Lonza Water Care Business

LOS ANGELES (Feb. 28, 2019) – Platinum Equity today announced it has completed the acquisition of Lonza’s water care business in a transaction valued at approximately $630 million.

Headquartered in Alpharetta, GA, the water care business is a leading provider of innovative water treatment solutions. The company maintains six production facilities throughout North America, South America, and EMEA, and sales locations in all major regions globally. It features top consumer brands in the residential pool care market and key positions in high-growth industrial water care markets.

Platinum Equity is a leading global private equity firm with a highly specialized focus on business operations and more than 20 years’ experience acquiring and operating businesses that have been part of large corporate entities. The firm has said it believes the water care business is a strong platform for growth thanks to its market position and track record for innovation.

Following the transfer of ownership and transition to operating as a standalone company, the water care business will create a new corporate identity that will be announced in the months ahead. No changes are expected to the company’s underlying consumer product brands.

Gibson, Dunn & Crutcher LLP served as legal advisor to Platinum Equity on the acquisition of Lonza’s water care business.

About Platinum Equity

Founded in 1995 by Tom Gores, Platinum Equity is a global investment firm with approximately $13 billion of assets under management and a portfolio of approximately 40 operating companies that serve customers around the world. The firm is currently investing from Platinum Equity Capital Partners IV, a $6.5 billion global buyout fund, and Platinum Equity Small Cap Fund, a $1.5 billion buyout fund focused on investment opportunities in the lower middle market. Platinum Equity specializes in mergers, acquisitions and operations – a trademarked strategy it calls M&A&O® – acquiring and operating companies in a broad range of business markets, including manufacturing, distribution, transportation and logistics, equipment rental, metals services, media and entertainment, technology, telecommunications and other industries. Over the past 23 years Platinum Equity has completed more than 250 acquisitions.

About the Water Care Business

The water care business acquired from Lonza is one of the world’s leading suppliers of sanitizers and other water treatment chemicals. It is organized into two business segments: Residential Water offers water care products and value-added services for residential pools and spas and is a global leader in all consumer channels including Mass Retail and Professional Dealer (Pro Dealer), which includes Dealer Direct, Branded Distribution, and Repack and Private Label (RPL). Industrial, Commercial, Municipal and Surface Water (ICMS) offers chemicals, services and solutions globally that address commercial swimming pools, drinking water, process water, wastewater, irrigation, surface water and industrial applications.

Investor Relations

and Media Contacts:

Mark Barnhill

Partner

+1 310.228.9514E-mail Mark

Dan Whelan

Principal

+1 310.282.9202E-mail Dan

EverSource Capital and NIIF announce partnership with CDC to invest in its renewable energy platform Ayana

Mumbai/London, 28 February 2019: EverSource Capital (a joint venture between Everstone Capital and Lightsource BP) and the National Investment and Infrastructure Fund of India (NIIF) have today announced a partnership with CDC Group in Ayana Renewable Power (Ayana), the renewable energy platform founded by CDC. EverSource Capital manages Green Growth Equity Fund (GGEF), which has NIIF and the UK government as anchor LPs. Completion is subject to regulatory and transaction condition approvals.

Ayana was launched to develop utility scale solar and wind generation projects across growth states in India. It is currently constructing 500MW of solar generation capacity with a strong future pipeline of renewable energy opportunities. With a management team that has a track record of successful execution of renewable energy projects, Ayana is well placed to play an important role in India’s ambition to build 175 GW of renewable energy capacity.

CDC’s Head of Asia, Mr. Srini Nagarajan said “CDC’s commitment to climate change was key in the innovation of Ayana last year and its alignment with the global goals. We are delighted we achieved our early objective to attract fresh capital and we are proud to partner with NIIF and EverSource Capital. Their domestic expertise will further strengthen Ayana and support its mission in developing affordable and accessible renewable energy across India. This investment demonstrates our commitment to invest a further $1.7 billion in India and neighboring countries over the next three years. Within infrastructure, we see further opportunities to provide investment to businesses operating within power generation, power transmission and distribution, transport, the gas midstream and the water sector.”

Sujoy Bose, MD & CEO, NIIF, said “The Indian renewable energy sector has seen strong traction underpinned by healthy capacity additions with globally competitive tariffs. We are pleased to be partnering with CDC and EverSource Capital and backing a strong management team with a successful track record of developing renewable energy in India. We look forward to working with our partners who bring complementary strengths and substantial capital to the platform.”

Dhanpal Jhaveri, CEO, EverSource Capital commented “This partnership brings together likeminded institutional, climate focussed and experienced partners. EverSource has a deep understanding of renewables business with an extensive track record of scaling up world class businesses in India and will provide strategic and operational value add to Ayana in building a high quality rapidly scalable utility grade renewable energy business.”

News release

Standard Chartered Bank acted as the exclusive financial advisor to Ayana Renewable Power Private Limited.

-Ends-

Notes to Editors:

About CDC Group: CDC Group plc is the UK’s development finance institution. Wholly owned by the UK Government, it invests in sub-Saharan Africa and South Asia with the aim

of supporting economic development to create jobs. CDC Group plc has invested in India since 1987. CDC takes a flexible approach and provides capital in all its forms, including equity, debt, mezzanine and guarantees, to meet businesses’ needs and achieve development impact. CDC has net assets of £5.1bn.

About NIIF: NIIF is a fund manager that invests in infrastructure and related sectors in India. An institution anchored by the Government of India, NIIF is a collaborative investment platform for international and Indian investors with a mandate to invest equity capital in domestic infrastructure. NIIF benefits from its association with the Government yet is

independent in its investment decisions being majority owned by institutional investors and managed professionally by a team with experience in investments and infrastructure. NIIF

aims to make commercial investments in the sector which are feasible and at scale. By providing local access and expertise, NIIF is expected to attract significant international capital in Indian infrastructure.

About EverSource Capital: EverSource Capital, a joint venture between Everstone Capital and Lightsource BP, is the fund manager of the Green Growth Equity Fund (GGEF), a USD

700 million target private fund, which has NIIF and the UK Government as anchor LPs, for investing in India’s rapidly scaling green growth market through a differentiated investment approach. This unique partnership brings together a leading multi-asset management firm in India and a renewable energy industry leader and Europe’s leading utility scale solar developer having a portfolio of more than 9 GW under operation / development including 60MW in India to form EverSource, the enabler of renewable energy and green investment opportunities in India.

Contact:

Karan Anand (For EverSource Capital)

Assistant Vice President, Communications & Marketing

(kanand@everstonecapital.com / +91 98333 72732)

Clare Murray, CDC Communications

(cmurray@cdcgroup.com / +44 7887 993356)

Adfactors PR (For NIIF)

Anita Bhoir, Senior Account Director

(anita.bhoir@adfactorspr.com / +91 99303 90055)

Contrast Security Closes $65 Million Series D Funding Round

Round led by new investor Warburg Pincus validates the visionary approach of Contrast’s

innovative software security platform

Los Altos, Calif., Feb. 28, 2019 – Contrast Security, the pioneer in embedding vulnerability

analysis and exploit prevention directly into modern software, today announced it has completed

a $65 million Series D funding round led by new investor, Warburg Pincus. Existing investors,

including Battery Ventures, General Catalyst, M12 (Microsoft’s Venture Fund), AXA Venture

Partners and Acero Capital all participated in the oversubscribed round. This brings the

company’s total funding raised to $122 million. This investment will strengthen Contrast

Security’s position as the leading platform to enable secure DevOps. The funding will accelerate

the company’s technology innovation, field operations, international expansion along with

significant growth in its customer-success team. These investments are all in order to meet the

rapidly increasing demand for the company’s modern approach to software security.

Businesses today are developing software at breakneck speeds fueled by modern approaches

such as Agile, DevOps, microservices, APIs, cloud-native apps and PaaS environments. This

creates a major gap between the demands for faster software development and the challenges

brought about by legacy software security tools. Contrast Security is a pioneer in creating a new

approach, leveraging patented binary instrumentation to protect applications at every point in

their lifecycle. Modern software requires an equally modern security model that can protect the

integrity of the business with innovative security safeguards built directly into the software as

they are developed and deployed.

“Everything about software today is different, from the increased dependence on third-party and

open source components, to microservices and API-centric architectures, and complex cloud

deployments. However, many companies still are trying to rely on 15-year-old legacy security

tools for their modern software stacks. This approach leaves them with restricted software

development capabilities or living with substantial enterprise risk of a data breach,” said Alan

Naumann, CEO at Contrast Security.

Modern software requires businesses to embrace innovative and modern software models,

changing the rules of engagement. For example, companies such as Slack created a revolution

in workforce collaboration built for modern software. AppDynamics and Atlassian have changed

the way performance management and issue tracking can be done seamlessly across business

functions. Modern software is built with innovative tools that are collaborative, cross-functional

and highly integrated. Contrast Security is breaking decades-old constraints as the first and only

software security platform that is built for the modern software era.

“With strong support from enterprise customers, key industry analysts validating our visionary

approach and extraordinary backing from top tier investors, we anticipate becoming the

essential foundation for modern software security with accurate and continuous software

protection. We are thrilled to have Warburg Pincus join us as a partner in this journey,” said

Naumann.

Contrast Security has experienced strong corporate growth and fast-yielding financial

performance in FY’2018 including:

• Overall ARR growth of >120%+ year-over-year

• Net upsell & expansion rates of >135%

• Significantly increased customer base with the addition of 520 new companies using

Contrast solutions

• 500 percent year-over-year growth in the number of $1 million or greater transactions

“Alan and the team at Contrast Security have built a formidable platform with a next-generation

approach to application security. Our market research shows that companies around the globe

are investing in Digital Transformation and software development initiatives. High speed

DevOps software and rapid cloud adoption create an enormous security risk if legacy tools are

used. These mega-trends create a uniquely large opportunity for Contrast Security,” said Brian

Chang, Managing Director at Warburg Pincus. “We are excited to back Contrast Security and to

further validate their position as a new, modern and truly scalable approach to application

security.”

Contrast Security’s unified platform includes its flagship products, Contrast Assess and Contrast

Protect, that work continuously across popular development approaches (DevOps, Agile,

Waterfall, etc.) and technologies (Cloud, Containers, Open Source Software, etc.) to enable

protection throughout the software lifecycle. Contrast Security’s platform allows IT executives to

finally close the chasm between the number of applications needed to run the business and the

resources needed to secure them. In 2018 alone, Contrast Security discovered over 1,900,000

vulnerabilities and protected against over 52,000,000 confirmed applications attacks across

billions of transactions.

“A major business goal at Comcast is to speed up the development process and shorten time to

market. This objective challenged us to identify next generation application security technology

that could provide us constant and accurate feedback for our application portfolio. Many tools

that claim to target this accelerating pace are nothing more than DevOps marketing lipstick on a

traditional tooling pig,” said Larry Maccherone, DevSecOps Transformation Lead at Comcast.

“However, Contrast fundamentally transforms the equation around vulnerability detection and

runtime protection. It fits the emergent DevOps mental model perfectly which is more than can

be said of any tool developed with the security specialist as its primary user.”

In addition, Contrast Security recently announced Community Edition, a free, full-strength,

DevSecOps solution that allows development, security and operations teams to deliver secure

software on time to meet growing business requirements. This free solution is designed to help

small teams building Java applications and APIs protect against the most commons security

flaws, including the Open Web Application Security Project (OWASP) top 10 vulnerabilities.

About Contrast Security

Contrast Security is the world’s leading provider of technology that embeds highly effective

vulnerability analysis and exploit prevention directly into modern software. Contrast’s patented

deep security instrumentation is the breakthrough technology that enables highly accurate

assessment and always-on protection of an entire application portfolio, without disruptive

scanning or expensive security experts. Only Contrast has sensors that work actively inside

applications to uncover vulnerabilities, prevent data breaches, and secure the entire enterprise

from development, to operations, to production. More information can be found at

www.contrastsecurity.com or by following Contrast on Twitter at @ContrastSec.

About Warburg Pincus

Warburg Pincus LLC is a leading global private equity firm focused on growth investing. The

firm has more than $43 billion in private equity assets under management. The firm’s active

portfolio of more than 180 companies is highly diversified by stage, sector and geography.

Warburg Pincus is an experienced partner to management teams seeking to build durable

companies with sustainable value. The firm is a leading investor in security companies, with

current investments including CrowdStrike, BitSight, eSentire, Cyren and Zimperium, among

others. Founded in 1966, Warburg Pincus has raised 17 private equity funds, which have

invested more than $73 billion in over 855 companies in more than 40 countries. The firm is

headquartered in New York with offices in Amsterdam, Beijing, Hong Kong, Houston, London,

Luxembourg, Mumbai, Mauritius, San Francisco, São Paulo, Shanghai and Singapore. For

more information, please visit www.warburgpincus.com.

ARDIAN INFRASTRUCTURE acquires Wind Farm from OX2 in first step to create new Nordic sustainable energie platform

Ardian’s Nordic platform led by industry executives Eero Auranne and Thomas Linnard will support transition towards sustainable energy in the region

The 53-turbine wind farm will be one of the largest in Sweden, which is a world leader in the innovation and development of sustainable energy. Sweden has passed legislation to go ‘carbon neutral’ by 2045, with Denmark, Norway and Finland all having made similar commitments.

Ardian’s portfolio in the Nordics, which already includes two wind farm investments in Norway and Sweden, will now exceed 400MW of gross capacity, corresponding to the yearly energy consumption of more than 600,000 electric vehicles. Separately, OX2 is currently building a record of over 1GW of wind power in the Nordics, of which approximately 90% is in Sweden.

Amir Sharifi, Managing Director at Ardian Infrastructure said: “In OX2, we have found an excellent partner. We look forward to together building a state-of-the-art wind farm using the latest available technology. Our goal is to achieve solid returns without subsidy and a positive impact on all stakeholders.”

Paul Stormoen, Managing Director at OX2 Wind said: “We are very pleased to have established a good business relationship with Ardian after a realisation process that was characterised by a high degree of professionalism and spirit of cooperation. We are now looking forward to beginning construction together with our sub-contractors. The wind farm is a significant local investment and a further important contribution to the ongoing global transition to a renewable energy sector.”

Mathias Burghardt, Member of the Executive Committee and Head of Ardian Infrastructure said: “As a leading investor in the sector, we see significant growth potential in supporting the rapid transition towards sustainable energy in the Nordics. This region has been a pioneer in energy innovation and building a liberalized power market. We look forward to building a leading independent Nordic platform that will become yet another example of how sustainability can provide value to both investors and society.”

Eero Auranne said: “Our partnership with Ardian, one of the largest private investment houses in the world, will provide both the resources and expertise to deliver on our plan to build a leading Nordic platform. We have already identified several interesting opportunities and look forward to taking advantage of them with Ardian’s support.”

Ardian has built or operated 2.3GW of renewable capacity in Europe and the Americas since 2006, including investments in wind, solar, hydro and biomass. Most recently, Ardian’s renewables platform in the US, Skyline Renewables, acquired four additional wind farms expanding its holdings to 803MW.

ADVISORS AND TECHNICAL DETAILS

Ardian advisors: Newsec, M&A; Vinge, legal; Grant Thornton, tax

The wind turbines are from the Nordex Delta4000 series, with a total height of 180 m. Project targets to exceed 250MW including upgrades (from an initial 220MW nominal capacity)

ABOUT ARDIAN

Through its commitment to shared outcomes for all stakeholders, Ardian’s activities fuel individual, corporate and economic growth around the world.

Holding close its core values of excellence, loyalty and entrepreneurship, Ardian maintains a truly global network, with more than 550 employees working from fifteen offices across Europe (Frankfurt, Jersey, London, Luxembourg, Madrid, Milan, Paris and Zurich), the Americas (New York, San Francisco and Santiago) and Asia (Beijing, Singapore, Tokyo and Seoul). It manages funds on behalf of around 800 clients through five pillars of investment expertise: Fund of Funds, Direct Funds, Infrastructure, Real Estate and Private Debt.

ABOUT OX2

PRESS CONTACTS

Headland

CARL LEIJONHUFVUD

Tel: +44 20 3805 4827

PAUL STORMOEN

Tel: +46 70-671 18 18

Bosch increases investment in startups

Robert Bosch Venture Capital launches Fund IV with 200 million euros

- Artificial intelligence: RBVC has a stake in three of the most promising AI startups worldwide

- Bosch CEO Denner: “We aim to foster technologies in areas of future relevance and boost our innovative strength”

- Bosch collaborates with startups on open innovation projects

Stuttgart, Germany – Investments in startups are on the rise. In 2017, institutional investors and companies invested 147 billion euros in these enterprises – nearly three times as much as in 2012.

Bosch, too, is increasing its investment in external startups, providing Robert Bosch Venture Capital GmbH (RBVC) with 200 million euros for a fourth fund. “Shaping the future also means recognizing good ideas early on and helping them achieve a breakthrough. As a leading IoT company, we want to drive forward select technologies in areas of future relevance, such as artificial intelligence,” explains Dr. Volkmar Denner, CEO of Robert Bosch GmbH. RBVC currently has a stake in three of the most promising artificial intelligence (AI) startups worldwide: DeepMap, Graphcore, and Syntiant. “We not only invest in startups, we also collaborate with them on open innovation projects. This is one way in which we boost our innovative strength.” Open innovation is a concept that brings together customers, researchers, suppliers, and partners and integrates them into a company’s innovation activities.

RBVC, one of Europe’s largest corporate investors, specializes in innovative technology startups. Its portfolio includes more than 35 companies active in autonomous driving, AI, the internet of things (IoT), and even distributed ledger technologies such as blockchain.

Blackstone Life Sciences and Novartis Launch Anthos Therapeutics to Develop Innovative Medicines for Cardiovascular Disease

Blackstone Life Sciences provides $250M Financing

Cambridge, Massachusetts, February 27, 2019 – Blackstone Life Sciences today announced the launch of Anthos Therapeutics Inc. (“Anthos”), a new biopharmaceutical company focused on advancing next-generation targeted therapies for high-risk cardiovascular patients.

As part of this launch, Novartis has licensed to Anthos MAA868, an antibody directed at Factor XI and XIa, key components of the intrinsic coagulation pathway. A large unmet medical need exists for next-generation anti-thrombotic therapies in patients currently underserved by conventional anti-coagulant therapies. As a promising anti-thrombotic modulating genetically and pharmacologically validated components of the intrinsic pathway, MAA868 has the potential to prevent a variety of cardiovascular disorders with minimal or no bleeding risk within a new long-acting treatment paradigm, which would provide major advantages over the conventional standards of care.

Funds managed by Blackstone Life Sciences, a private investment platform with capabilities to invest across the lifecycle of companies and products within the key life sciences sectors, provided $250M for Anthos and will control the development of the products. Novartis will retain a minority equity interest in Anthos.

According to the American Heart Association, thrombotic disorders cause nearly 500,000 deaths each year. Thrombotic disorders can affect arteries or veins, manifesting as ischemic heart disease, ischemic stroke, peripheral artery disease, venous thromboembolism, and many debilitating orphan diseases. Atrial fibrillation, the most common type of heart arrhythmia, is a major risk factor for ischemic stroke and systemic arterial thromboembolism.

“The need for new medicines to treat cardiovascular diseases is clear, and this agreement is part of our strategy to work with innovators outside our walls to advance medicines that have the potential to have a positive impact for patients,” said Jay Bradner, MD, President of the Novartis Institutes for BioMedical Research. “Blackstone Life Sciences has the necessary experience and has assembled a first-class team at Anthos to drive the further development of MAA868.”

“Blackstone Life Sciences is focused on bringing important medicines and healthcare technologies to market, often working in partnership with major biopharmaceutical companies to provide them with access to capital, scientific expertise and hands-on operational leadership,” said Nick Galakatos, Ph.D., Head of Blackstone Life Sciences and Chairman of Anthos. “We are excited to collaborate with Novartis to create Anthos, with the goal of delivering important therapies for the high-risk cardiovascular patients who need them.”

Founding members of Anthos’ Board of Directors include Blackstone Managing Director Paris Panayiotopoulos, former CEO of Ariad Pharmaceuticals, and Blackstone Principal Ari Brettman, MD. Jonathan Freeman, MBA, Ph.D., Blackstone Senior Advisor and Anthos co-founder, joins as Chief Operating Officer.

Shaun Coughlin, MD, Ph.D., Novartis’ Global Head of Cardiovascular and Metabolism joins as an Observer to Anthos’ Board. Craig Basson, MD, Ph.D., Novartis’ Head of Cardiovascular and Metabolism Translational Medicine joins Anthos’ Scientific Advisory Board.

John Glasspool, a former leader of Novartis’ cardiovascular franchise with 30 years of experience in the biopharmaceutical industry, joins Anthos as CEO. Mr. Glasspool served as Global Head of Novartis’ Cardiovascular and Metabolic Diseases franchise from 2004-2008 and more recently served as Head of Corporate Strategy and a member of the Executive Team at Baxalta that led its acquisition by Shire.

“I am excited to be leading Anthos upon its formation by Blackstone Life Sciences and Novartis. Anthos is well-positioned to leverage contributions from Blackstone and Novartis to deliver life-saving therapies to patients with cardiovascular disease. We are building a leading cardiovascular company, laser focused on genetically and pharmacologically validated targets.” said Mr. Glasspool.

Anthos Therapeutics is based in Cambridge, Massachusetts.

About Anthos Therapeutics

Anthos Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on the development and commercialization of genetically and pharmacologically validated therapies for high-risk cardiovascular patient populations. Anthos’ most advanced program is MAA868, an anti- Factor XI / XIa monoclonal antibody, which represents a promising next generation anti-thrombotic investigational therapy with the potential to prevent multiple thrombotic diseases with minimal or no bleeding risk. Anthos is located in Cambridge, Massachusetts.

About Blackstone Life Sciences

Blackstone Life Sciences is a private investment platform with capabilities to invest across the life-cycle of companies and products within the key life science sectors. By combining scale investments and hands-on operational leadership, Blackstone Life Sciences helps bring to market promising new medicines that improve patients’ lives. In launching this new platform, Blackstone acquired Clarus, a leading global life-sciences firm.

Contacts

Blackstone

Jennifer Friedman

+1 (212) 583-5122

Jennifer.Friedman@blackstone.com

Novartis

Eric Althoff

+1 (646) 438-4335

Eric.Althoff@novartis.com

Aptean Partners with TA Associates and Vista Equity Partners to Accelerate Growth

Alpharetta, GA – Aptean, a leading global provider of mission-critical, industry-specific enterprise software solutions, announced today that it will receive a joint investment from TA Associates (“TA”) and Vista Equity Partners (“Vista”).

Together with Aptean’s executive management team, TA and Vista plan to accelerate Aptean’s growth as the company aims to continue providing best-in-class manufacturing ERP, supply chain and compliance solutions to its customers globally.

TA and Vista will be equal partners, each investing new equity to acquire Aptean from the separate Vista fund that initially invested in the company in 2012. Moving forward, the partnership between TA and Vista will provide Aptean with the benefits of two experienced investment partners, enabling the company to leverage TA’s global add-on acquisition origination and integration capabilities alongside Vista’s proven operational expertise with the aim of positioning Aptean for substantial organic and inorganic growth.

“We are thrilled to partner with TA and Vista as we enter this next phase of growth,” said TVN Reddy, CEO of Aptean. “Over the past year, we streamlined and re-focused Aptean’s product portfolio through the divestitures of Aptean’s public sector, healthcare, and vertical business applications assets. We believe Vista’s continued commitment and TA’s new perspective will equip us with the external resources, capital, and expertise to further strengthen and advance Aptean as the market leader in manufacturing ERP, supply chain and vertically-focused compliance solutions globally.”

Leading up to this investment, Vista and Aptean’s leadership team executed on a plan to focus the company’s product portfolio exclusively on Aptean’s industry-specific ERP, supply chain and compliance solutions. In July 2018, Aptean announced the divestiture of its public sector and healthcare assets, and in October 2018, the company sold its vertical business applications assets. As a result, Aptean is now solely positioned to invest in its core, vertical solutions and continue the development of next-generation SaaS products for its customers.

“We are very pleased to be investing in Aptean, one of the leading manufacturing ERP, supply chain and compliance software providers globally,” said Hythem El-Nazer, a Managing Director at TA Associates. “With its global and loyal customer base, talented management team and accelerating focus towards delivering cloud products, we believe Aptean is well positioned to take advantage of organic and inorganic strategic initiatives. Furthermore, we are confident that the combination of the breadth of value-add capabilities that TA and Vista bring will help enable further acceleration in growth. We are excited about the next chapter of Aptean and are committed to ensuring the business has the resources necessary to continue to innovate and bring new products and functionality to customers.”

“We see a tremendous opportunity for Aptean’s continued growth as we partner with TA during the next phase of value creation,” said Marc Teillon, a partner at Vista Equity Partners. “The company’s sharp focus positions it to take advantage of vertical-specific market requirements that necessitate purpose-built solutions. We look forward to working with TA and Aptean’s leadership team to maximize the opportunities within the existing product set while remaining focused on acquisitions to meaningfully expand Aptean’s product depth and geographic footprint through acquisition.”

DLA Piper served as the legal advisor to TA Associates. Atlas Technology Group served as the financial advisor to Vista, and Kirkland & Ellis and Ropes & Gray served as legal advisors.

The transaction is subject to customary closing conditions and is expected to close during the second quarter of 2019.

About Aptean

Aptean is a global provider of mission-critical, industry-specific software solutions. Aptean’s purpose-built ERP and supply chain management solutions help address the unique challenges facing process and discrete manufacturers, distributors, and other focused organizations. Aptean’s compliance solutions are built for companies serving specific markets such as finance, healthcare, biotech and pharmaceuticals. Over 2,500 organizations in more than 20 industries across 54 countries trust Aptean’s solutions at their core to assist with running their operations. To learn more about Aptean and the markets we serve, visit www.aptean.com.

About TA Associates

TA Associates is one of the largest and most experienced global growth private equity firms. Focused on five target industries – technology, healthcare, financial services, consumer and business services – TA invests in profitable, growing companies with opportunities for sustained growth, and has invested in more than 500 companies around the world. Investing as either a majority or minority investor, TA employs a long-term approach, utilizing its strategic resources to help management teams build lasting value in growth companies. TA has raised $24 billion in capital since its founding in 1968 and is committing to new investments at the pace of $2 billion per year. The firm’s more than 85 investment professionals are based in Boston, Menlo Park, London, Mumbai and Hong Kong. More information about TA Associates can be found at www.ta.com.

About Vista Equity Partners

Vista Equity Partners is a U.S.-based investment firm with offices in Austin, Chicago, New York City, Oakland, and San Francisco with more than $46 billion in cumulative capital commitments. Vista exclusively invests in software, data, and technology-enabled organizations led by world-class management teams. As a value-added investor with a long-term perspective, Vista contributes professional expertise and multi-level support towards companies to realize their full experience in structuring technology-oriented transactions, and proven management techniques that yield flexibility and opportunity. For more information, please visit www.vistaequitypartners.com