Search, Perfected for AI: Why We’re Doubling Down on Exa

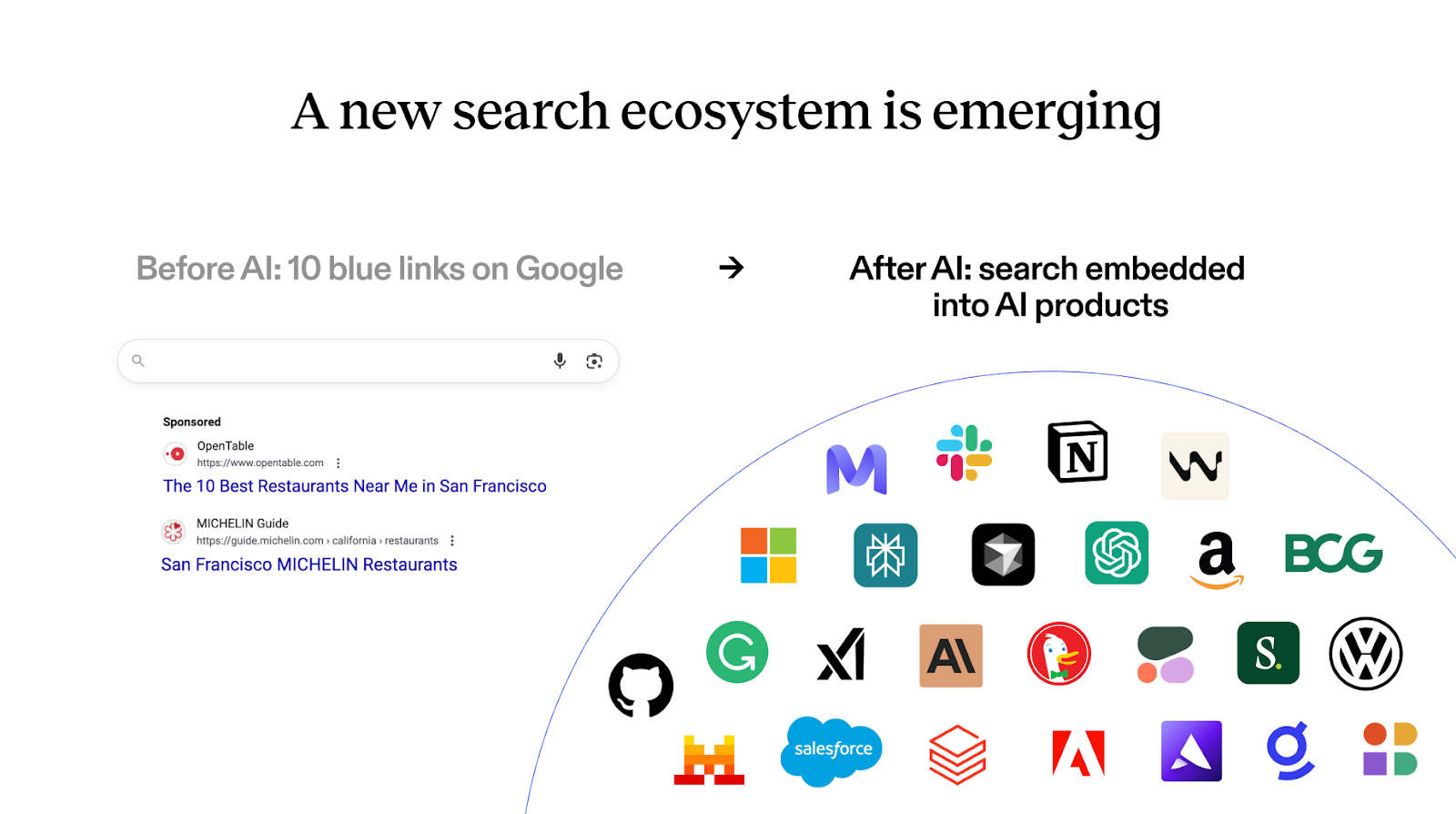

AI agents and AI-native products are here. These AIs need access to information, critical context that helps them perform at their best. “Garbage in, garbage out” still applies — no matter how intelligent the model, its reasoning is contingent on the availability of fresh, accurate data. In other words, they need search. Application builders are rapidly integrating and embedding search capabilities into a range of AI products – from consumer apps to B2B tools. This is where Exa comes in.

Exa is an applied AI lab training a search engine optimized for AI agents to perfect web search and improve upon the “ten blue links” paradigm that Google defined in the early days of the web. Exa’s goal is to create the world’s most powerful search technology, and unlike Google, they aren’t bound by optimizing for consumer clicks and SEO.

When Lightspeed led Exa’s Series A round last year, agents were only just beginning to take off. Now, they’ve taken over.

Exa has become the leading search engine for AI. For example, AI coding products like Cursor use Exa to retrieve technical documentation to output well-informed, up-to-date code. Today, thousands of developers, AI startups, and enterprises are building on top of the Exa API.

It’s why we’re excited to double down on our investment as part of Exa’s $85M Series B round, led by Peter Fenton at Benchmark Capital, alongside participation from YCombinator and NVIDIA Ventures. Peter served on the board of Elastic, the last major search company built, so we are delighted to see he shares our conviction about this massive opportunity.

Agents are merely large language models paired with appropriate tools. We believe search is one of the two big “killer tools” for agents, along with code execution. With code execution, agents become “Turing complete”, enabling them to write programs on the fly. With search, agents become “information complete” — they can acquire any public information needed to accomplish a task.

While AI models are trained on increasingly vast sums of data, AI models cannot perfectly memorize all the information on the public web, as their recall is unreliable. Further, there’s always a “last mile” of data — private data, alternative data sources, etc. — which will never end up in the training data of these models. For AIs to work with and reason about this data, they require search capabilities.

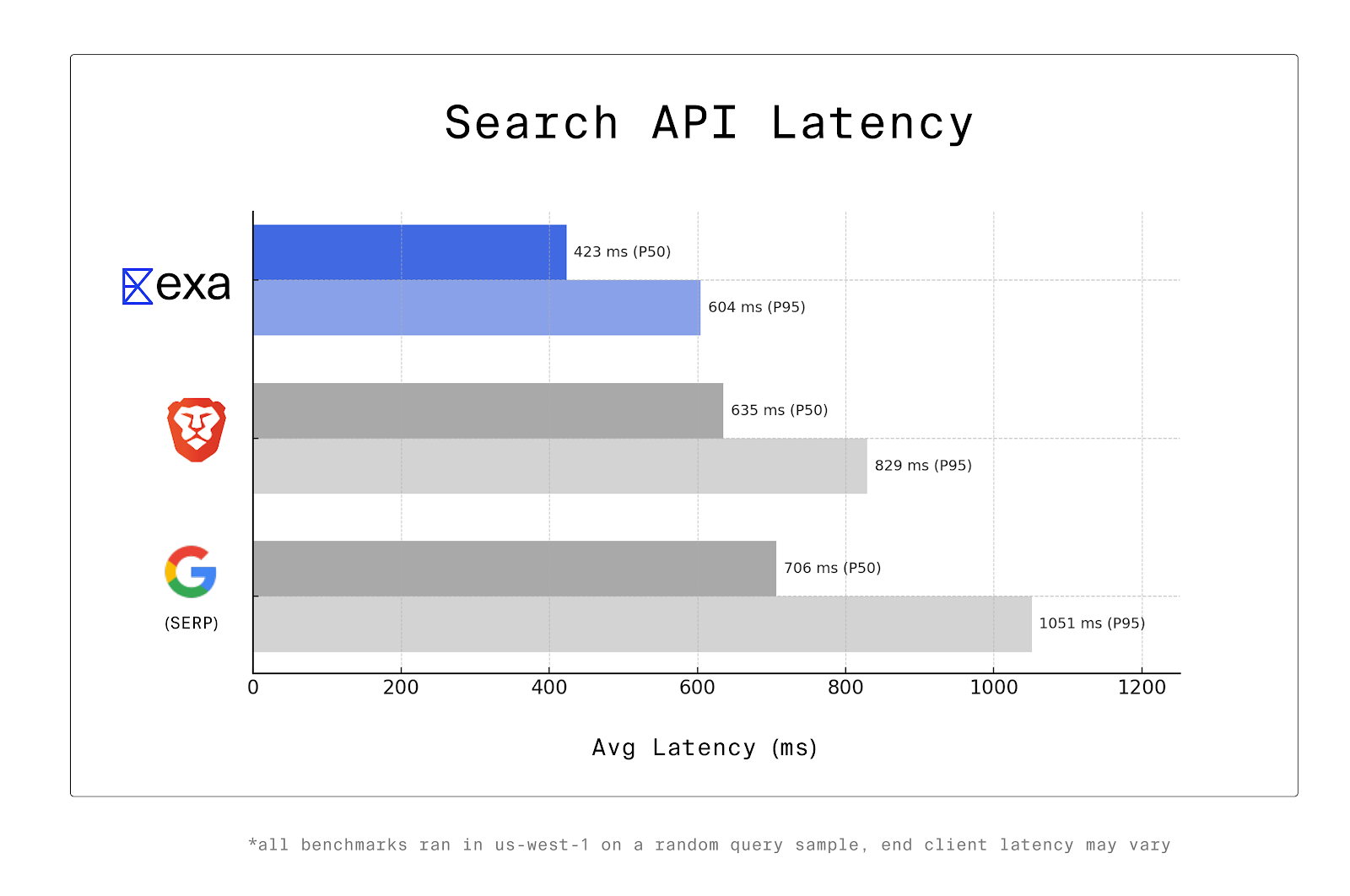

Exa is strategically positioned to power search for AI. Exa indexes billions of web documents, processes through them all with their custom models, and serves them through a state-of-the-art search and retrieval stack. The quality and craftsmanship of the Exa team is evident through benchmarks, where Exa is best-in-class in terms of relevance and latency.

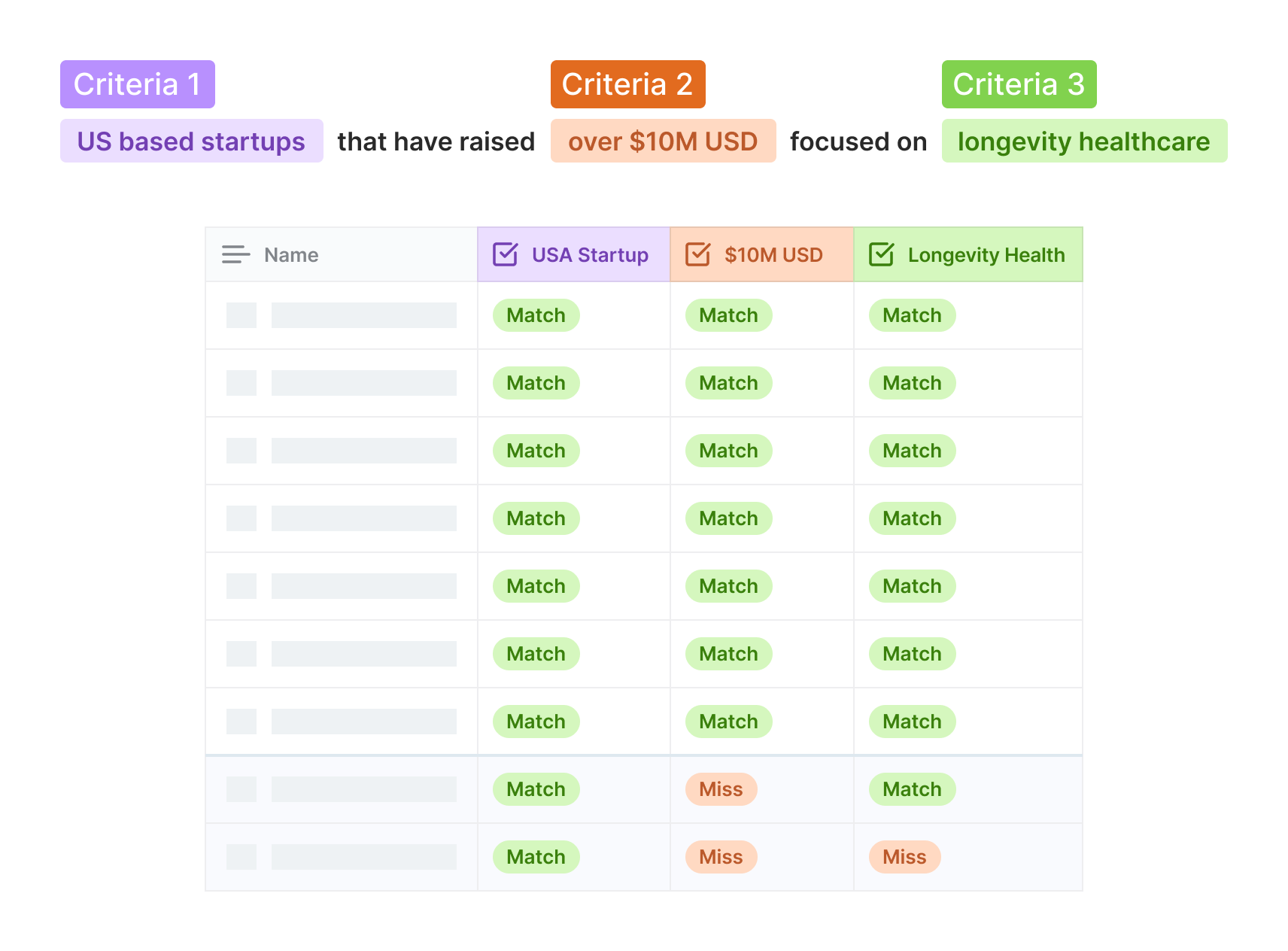

This incredible performance is no longer limited to AI consumption — Exa now serves human users too via its new product, Websets, an agentic search tool for extracting structured information from the unstructured web. Non-technical users can write a query asking for lists of people, companies, and more (e.g., “US-based startups that have raised over $10M USD focused on longevity healthcare”) and get hundreds of results matching the exact criteria, verified by Exa’s AI agents. Websets has become incredibly popular for recruiting, lead generation, and market research use cases.

But they aren’t stopping there: the Exa team has set out an aggressive product roadmap for the coming years, with the goal of powering every AI app, indexing beyond the public web, and becoming the AI world’s data layer.

We are heading toward a future where AIs search far more than humans, where most search queries actually originate from an AI of some kind rather than a human. We believe this new world will require AI-native search infrastructure to support this new, rapidly growing consumer of the web.

That’s Exa — a single API to get any information from the web, built specifically for AI products. Lightspeed is proud to continue supporting Exa’s vision of perfect search. If you want to work on industry-changing, high-impact, massive-scale challenges, apply here.

The content here should not be viewed as investment advice, nor does it constitute an offer to sell, or a solicitation of an offer to buy, any securities. Certain statements herein are the opinions and beliefs of Lightspeed; other market participants could take different views.

Authors