- KKR to become 12% common shareholder in Henry Schein

- Henry Schein and KKR to collaborate on range of value creation opportunities

- Two KKR representatives with deep sector experience to join the Henry Schein Board as independent directors

- Separately, Robert J. Hombach, who brings extensive financial and strategic experience in health care, has joined the Henry Schein Board as an independent director

- Announces preliminary unaudited fourth-quarter 2024 GAAP diluted EPS of $0.74 and non-GAAP diluted EPS of $1.19, and preliminary 2025 financial guidance for full-year non-GAAP EPS of low to mid single digit growth

- In addition, Henry Schein has increased its share repurchase program authorization by $500 million

MELVILLE, N.Y.–(BUSINESS WIRE)–Henry Schein, Inc. (Nasdaq: HSIC) (“Henry Schein” or the “Company”), the world’s largest provider of health care solutions to office-based dental and medical practitioners, today announced a strategic investment by funds affiliated with KKR, a leading global investment firm.

“Our Board and management have great respect for KKR, including its partnership-oriented approach and experience in supporting value creation across its investments,” said Stanley Bergman, CEO, Henry Schein.

In addition to KKR’s current holdings, KKR will make an additional $250 million investment in the Company’s common stock (the “Investment”). As a result, KKR will become the largest non-index fund shareholder in the Company with a 12% position, demonstrating the firm’s confidence in Henry Schein, its management team, and its BOLD+1 strategy. KKR will also have the ability to purchase additional shares via open market purchases up to a total equity stake of 14.9% of the outstanding common shares of the Company.

In addition, under the agreement between Henry Schein and KKR, Max Lin and William K. “Dan” Daniel will join Henry Schein’s Board of Directors (the “Board”) as independent directors.

Mr. Lin is a partner at KKR where he leads the Health Care industry team within its Americas Private Equity platform. He will join the Board’s Nominating and Governance Committee as Vice Chair to participate in governance matters, including the ongoing consideration of Board composition and the Board’s ongoing CEO succession planning process. Mr. Lin will also join the Strategic Advisory Committee, which oversees the Company’s strategic planning activities.

Mr. Daniel, an executive advisor to KKR and former Executive Vice President at Danaher Corporation, will join the Board’s Compensation and Strategic Advisory Committees.

Separately, the Board has appointed Robert J. “Bob” Hombach as an independent director. Mr. Hombach, former Executive Vice President, Chief Financial Officer and Chief Operations Officer of Baxalta Inc. and prior to this, Corporate Vice President and Chief Financial Officer of Baxter International Inc., is expected to join the Board’s Strategic Advisory Committee.

These highly experienced executives will add to the Company’s significant and complementary expertise across finance, operations, and in dental and other areas of health care. With these appointments, the Board will temporarily increase to 16 directors before reducing to 14 directors effective immediately following the Company’s 2025 Annual Meeting and expects to further reduce the size of the Board over time.

Together, Henry Schein and KKR will collaborate to pursue additional opportunities to create shareholder value and drive the business in its next phase of growth, with a specific focus on strategic growth, operational excellence, capital allocation, and employee engagement, including exploring broad-based equity ownership.

“Our Board and management have great respect for KKR, including its partnership-oriented approach and experience in supporting value creation across its investments. This is a testament to the hard work of Team Schein to advance our leadership as a solutions-driven innovator for health care professionals,” said Stanley M. Bergman, Chairman of the Board and Chief Executive Officer of Henry Schein. “We regularly engage with our shareholders and welcome their constructive dialogue, advice, and recommendations. We look forward to collaborating with Max, Dan, and Bob in pursuing the opportunities ahead of us and building on Henry Schein’s incredible foundation.”

“We have long admired Stan and the broader Henry Schein organization. KKR is excited to support Henry Schein in its mission of enabling dental and medical practitioners, and believe the Company has tremendous growth potential. We look forward to working with the management team on strategic and operational initiatives to drive value for all of Henry Schein’s stakeholders,” said Mr. Lin.

“Henry Schein is an exceptional company with a well-earned reputation for innovation, quality relationships with customers, and a talented team. I am honored to join the Henry Schein Board and look forward to contributing to creating significant value for all of Henry Schein’s stakeholders in the years ahead,” said Mr. Hombach.

Upon consummation of the transactions, the Company will issue new shares of common stock to funds affiliated with KKR for an investment of $250 million, based on market price. KKR is funding this investment primarily from North America Fund XIII. As part of the agreement, KKR has also agreed to customary voting and other provisions. The consummation of the transactions is subject to customary closing conditions, including the expiration or termination of any waiting period under the Hart-Scott-Rodino Act and foreign regulatory approvals. The full agreement between Henry Schein and KKR will be filed on a Form 8-K with the Securities and Exchange Commission (the “SEC”).

Preliminary, Unaudited Fourth-Quarter and Full-Year 2024 Financial Results

Henry Schein also today reported preliminary, unaudited revenue, Adjusted EBITDA, earnings, and operating cash flow for the fourth quarter and fiscal year ended December 28, 2024:

- Preliminary revenue in the fourth quarter totaled $3.2 billion, bringing revenue for the full year of 2024 to $12.7 billion.

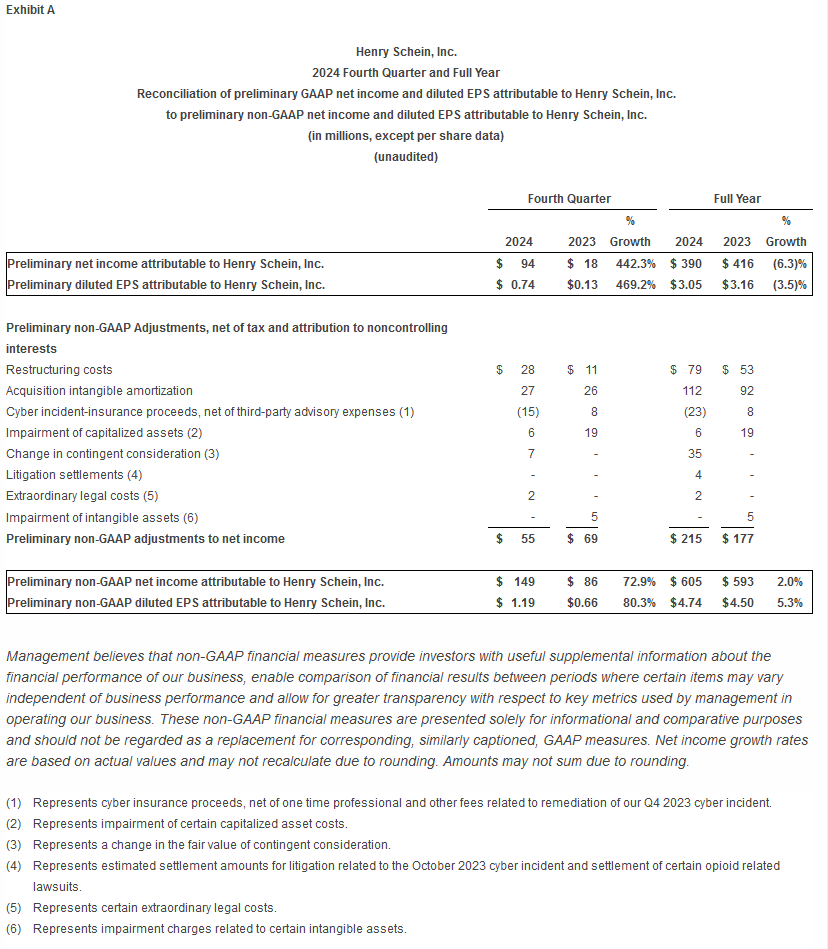

- Preliminary GAAP net income for the fourth quarter was $94 million, or $0.74 per diluted share, resulting in preliminary full-year 2024 GAAP net income of $390 million, or $3.05 per diluted share.

- Preliminary non-GAAP net income for the fourth quarter was $149 million, or $1.19 per diluted share, resulting in preliminary full-year 2024 non-GAAP net income of $605 million, or $4.74 per diluted share.

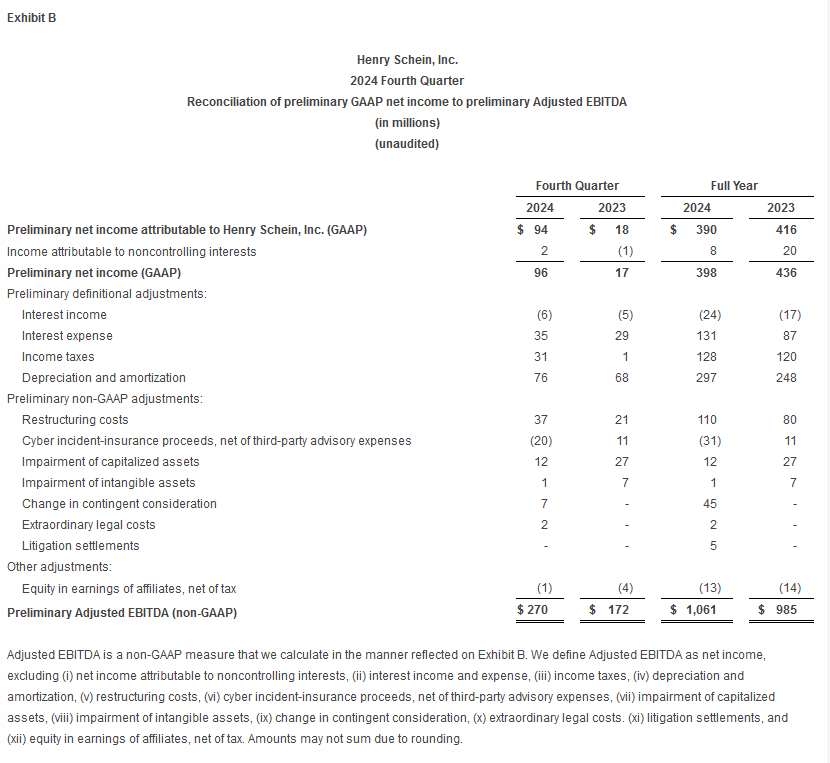

- Preliminary Adjusted EBITDA for the fourth quarter was $270 million, resulting in preliminary full-year 2024 Adjusted EBITDA of $1,061 million.

- Preliminary fourth quarter and full year 2024 operating cash flow was $204 million and $848 million, respectively.

Exhibit A includes the GAAP to non-GAAP reconciliation of preliminary net income and preliminary earnings per share. Exhibit B includes a reconciliation of preliminary GAAP net income to preliminary Adjusted EBITDA.

Preliminary Full-Year 2025 Financial Guidance

Henry Schein also today announced preliminary financial guidance for 2025. Revenues and non-GAAP diluted earnings per share are both expected to grow in the range of low to mid-single digits in 2025 as compared to 2024. Adjusted EBITDA is expected to grow in a mid-single digit range in 2025 as compared to 2024.

Guidance is for current continuing operations as well as announced acquisitions and does not include the impact of restructuring and integration expenses, amortization expense of acquired intangible assets, certain expenses directly associated with the cybersecurity incident or any potential insurance claim recovery, and extraordinary legal and advisory expenses. This guidance also assumes modest improvement in the dental and medical markets during the year, supported by our strategic initiatives and recent investments, a net positive contribution from our restructuring plan offset by investments in technology and new product launches, and that foreign currency exchange rates remain generally consistent with 2024 levels.

The Company is providing preliminary guidance for 2025 diluted EPS on a non-GAAP basis and for preliminary 2025 Adjusted EBITDA, as noted above. The Company is not providing a reconciliation of its preliminary 2025 non-GAAP guidance to its preliminary 2025 diluted EPS prepared on a GAAP basis, or its preliminary 2025 Adjusted EBITDA to net income prepared on a GAAP basis. This is because the Company is unable to provide without unreasonable effort an estimate of restructuring costs related to an ongoing initiative to drive operating efficiencies, including the corresponding tax effect, which will be included in the Company’s preliminary 2025 diluted EPS and net income prepared on a GAAP basis. The inability to provide this reconciliation is due to the uncertainty and inherent difficulty of predicting the occurrence, magnitude, financial impact, and timing of related costs. Management does not believe these items are representative of the Company’s underlying business performance. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Share Repurchase Authorization

In addition, the Company’s Board of Directors has authorized an increase of $500 million to the Company’s stock repurchase program, with $250 million to be executed through accelerated share repurchases.

Fourth Quarter and Full-Year 2024 Results and Conference Call

The Company intends to release its fourth quarter and full-year 2024 financial results before the stock market opens on Tuesday, February 25, 2025, and will provide a live webcast of its earnings conference call on the same day beginning at 8:00 a.m. Eastern time.

Advisors

Centerview Partners LLC and Evercore Inc. are serving as financial advisors and Cleary Gottlieb Steen & Hamilton LLP is serving as legal advisor to Henry Schein. Kirkland & Ellis LLP is serving as legal advisor to KKR.

About Max Lin

Max Lin leads the Health Care industry team within KKR. He is a member of the Investment Committee and Portfolio Management Committee for Americas Private Equity, the Health Care Strategic Growth Investment Committee, and the Global Conflicts and Compliance Committee. Since joining KKR in 2005, Mr. Lin has overseen a number of investments in the areas of dental services and other health care providers, medical products and equipment, and health care software and information technology. He holds a B.S. and B.A.S., summa cum laude, from the University of Pennsylvania and an M.B.A. from Harvard Business School.

About William K. “Dan” Daniel

Mr. Daniel has over three decades of global leadership experience in Industrial and Healthcare sectors, including 14 years as Executive Vice President at Danaher, where he oversaw multiple segments and played a key role in advancing the company’s culture and business system. He also served as executive sponsor of Danaher’s Diversity & Inclusion Council before retiring in 2020. Mr. Daniel has most recently served as an Executive Advisor to KKR.

About Robert J. Hombach

Mr. Hombach served as Executive Vice President, Chief Financial Officer and Chief Operations Officer of Baxalta Inc., a public biopharmaceutical company, until it was acquired by Shire plc, in June 2016. Baxalta was spun off from its parent, Baxter International Inc. in July 2015, where Mr. Hombach served as Corporate Vice President and Chief Financial Officer. Mr. Hombach currently serves on the board of BioMarin Pharmaceuticals Inc., a public biotechnology company, and Embecta Corporation, a public diabetes company. He has also previously served on the boards of Aptinyx Inc., CarMax, Inc., Naurex, Inc., and Surgical Innovation Associates, Inc. Mr. Hombach holds an M.B.A. from Northwestern University’s J.L. Kellogg Graduate School of Management and a B.S. in Finance cum laude from the University of Colorado.

About Henry Schein, Inc.

Henry Schein, Inc. (Nasdaq: HSIC) is a solutions company for health care professionals powered by a network of people and technology. With approximately 26,000 Team Schein Members worldwide, the Company’s network of trusted advisors provides more than 1 million customers globally with more than 300 valued solutions that help improve operational success and clinical outcomes. Our Business, Clinical, Technology, and Supply Chain solutions help office-based dental and medical practitioners work more efficiently so they can provide quality care more effectively. These solutions also support dental laboratories, government and institutional health care clinics, as well as other alternate care sites.

Henry Schein operates through a centralized and automated distribution network, with a selection of more than 300,000 branded products and Henry Schein corporate brand products in our distribution centers.

A FORTUNE 500 Company and a member of the S&P 500® index, Henry Schein is headquartered in Melville, N.Y., and has operations or affiliates in 33 countries and territories. The Company’s sales reached $12.3 billion in 2023, and have grown at a compound annual rate of approximately 11.5 percent since Henry Schein became a public company in 1995.

For more information, visit Henry Schein at www.henryschein.com, Facebook.com/HenrySchein, Instagram.com/HenrySchein, LinkedIn.com/Company/HenrySchein, and @HenrySchein on X.

About KKR

KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com. For additional information about Global Atlantic Financial Group, please visit Global Atlantic Financial Group’s website at www.globalatlantic.com.

Cautionary Note Regarding Forward-Looking Statements and Use of Non-GAAP Financial Information

In accordance with the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995, we provide the following cautionary remarks regarding important factors that, among others, could cause future results to differ materially from the forward-looking statements, expectations and assumptions expressed or implied herein.

The information set forth in this press release, including statements regarding the expected changes to the Board, the shares to be issued in the Investment, satisfaction of the conditions set forth in the agreement, our preliminary, unaudited financial results for 2024 and our initial 2025 financial guidance constitute or may be deemed to constitute forward-looking statements (including within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995). These expectations and statements are prospective in nature and are subject to risks and uncertainties and are not guarantees of future performance, including statements about the consummation of the expected changes to the Board or the Investment and the anticipated benefits thereof. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Some forward-looking statements discuss the Company’s plans, strategies and intentions and are generally identified by the use of such terms as “will be,” “subject to,” “may,” “could,” “expect,” “intend,” “believe,” “plan,” “estimate,” “forecast,” “project,” “anticipate,” “to be,” “to make” or other comparable terms. A fuller discussion of our operations, financial condition and status of litigation matters, including factors that may affect our business and future prospects, is contained in other documents we have filed with the United States Securities and Exchange Commission, or SEC, including our Annual Report on Form 10-K, and will be contained in all subsequent periodic filings we make with the SEC. These documents identify in detail important risk factors that could cause our actual performance to differ materially from current expectations.

Risk factors and uncertainties that could cause actual results to differ materially from current and historical results include, but are not limited to: the possibility that the expected changes to the Board or the Investment are not consummated and that any of the anticipated benefits will not be realized or will not be realized within the expected time period, our dependence on third parties for the manufacture and supply of our products; our ability to develop or acquire and maintain and protect new products (particularly technology products) and technologies that achieve market acceptance with acceptable margins; transitional challenges associated with acquisitions, dispositions and joint ventures, including the failure to achieve anticipated synergies/benefits, as well as significant demands on our operations, information systems, legal, regulatory, compliance, financial and human resources functions in connection with acquisitions, dispositions and joint ventures; certain provisions in our governing documents that may discourage third-party acquisitions of us; adverse changes in supplier rebates or other purchasing incentives; risks related to the sale of corporate brand products; security risks associated with our information systems and technology products and services, such as cyberattacks or other privacy or data security breaches (including the October 2023 incident); effects of a highly competitive (including, without limitation, competition from third-party online commerce sites) and consolidating market; changes in the health care industry; risks from expansion of customer purchasing power and multi-tiered costing structures; increases in shipping costs for our products or other service issues with our third-party shippers; general global and domestic macro-economic and political conditions, including inflation, deflation, recession, ongoing wars, fluctuations in energy pricing and the value of the U.S. dollar as compared to foreign currencies, and changes to other economic indicators, international trade agreements, potential trade barriers and terrorism; geopolitical wars; failure to comply with existing and future regulatory requirements; risks associated with the EU Medical Device Regulation; failure to comply with laws and regulations relating to health care fraud or other laws and regulations; failure to comply with laws and regulations relating to the collection, storage and processing of sensitive personal information or standards in electronic health records or transmissions; changes in tax legislation; risks related to product liability, intellectual property and other claims; risks associated with customs policies or legislative import restrictions; risks associated with disease outbreaks, epidemics, pandemics (such as the COVID-19 pandemic), or similar wide-spread public health concerns and other natural or man-made disasters; risks associated with our global operations; litigation risks; new or unanticipated litigation developments and the status of litigation matters; our dependence on our senior management, employee hiring and retention, and our relationships with customers, suppliers and manufacturers; and disruptions in financial markets. The order in which these factors appear should not be construed to indicate their relative importance or priority.

We caution that these factors may not be exhaustive and that many of these factors are beyond our ability to control or predict. Accordingly, any forward-looking statements contained herein should not be relied upon as a prediction of actual results. We undertake no duty and have no obligation to update forward-looking statements except as required by law.

Included within the press release are non-GAAP financial measures that supplement the Company’s Consolidated Statements of Income prepared under generally accepted accounting principles (GAAP). These non-GAAP financial measures adjust the Company’s actual results prepared under GAAP to exclude certain items. In the schedule attached to the press release, the non-GAAP measures have been reconciled to and should be considered together with the Consolidated Statements of Income. Management believes that non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance and allow for greater transparency with respect to key metrics used by management in operating our business. The impact of certain items that are excluded include integration and restructuring costs, and amortization of acquisition-related assets, because the amount and timing of such charges are significantly impacted by the timing, size, number and nature of the acquisitions we consummate and occur on an unpredictable basis. These non-GAAP financial measures are presented solely for informational and comparative purposes and should not be regarded as a replacement for corresponding, similarly captioned, GAAP measures.

Contacts

Investors

Ronald N. South

Senior Vice President and Chief Financial Officer

ronald.south@henryschein.com

(631) 843-5500

Graham Stanley

Vice President, Investor Relations and Strategic Financial Project Officer

graham.stanley@henryschein.com

(631) 843-5500

Media

Henry Schein

Gerard Meuchner

Vice President, Chief Global Communications Officer

gerard.meuchner@henryschein.com

(631) 390-8227

KKR

Liidia Liuksila

media@KKR.com