Gimv increases its interest in German GPNZ to further support and develop the dental platform in its growth ambitions

05/05/2021 – 07:30 | Portfolio

Gimv has increased its interest in GPNZ (Gesellschaft für Praxisnachfolge in der Zahnmedizin), a fast-growing, high-quality dental platform in Germany. In addition to a significant capital increase into the company, Gimv has acquired the shares of co-investors Cannonball® and co-founder Marcus Geier. The founder and CEO of GPNZ Roman Wachtel also participated in the capital increase. The additional resources will be used to conclude further partnerships and to continue the group’s dynamic growth path.

The dentistry group GPNZ (Gesellschaft für Praxisnachfolge in der Zahnmedizin, Munich, – www.gpnz.de) was launched in late 2018 with the aim of becoming a leading high-quality dental chain in Germany through buy and build. In collaboration with the co-investors and the current management, GPNZ has established itself as a fast growing dental platform, having assembled a group of high quality dental practices and supported them with tailor-made development plans, backed by a strong team at the Munich headquarters as well as effective regional support.

Acquisition of high quality and successful dental practices with best-in-class dentists and staff is an essential part of GPNZ’s consolidation strategy in a large but highly fragmented market, bringing benefits for dentists, staff and patients. Dentists reduce time spent on administrative, HR, marketing or commercial tasks and can focus on their medical role. They also gain flexibility in working hours and reduce their entrepreneurial risk. Staff is supported in terms of marketing, recruiting, and invoicing. Patients benefit from a wider range of professional medical services under one roof and convenience, either through additional specialisations, greater capacity or extended opening hours. Patient satisfaction and ensuring top quartile medical quality as a minimum standard in each practice are key priorities for GPNZ.

Despite the Covid pandemic, GPNZ has maintained strong momentum, with a further nine practices coming on board or having signed in the last 15 months. The company is led by an experienced management team with expertise in various healthcare fields (compliance, dentistry, marketing, hospital management, etc.) to fully support the organic growth of the practices. Long-term mutual goal alignment is ensured by management’s co-investment into GPNZ.

In the transaction announced today, co-founders Cannonball® and Marcus Geier, both having played instrumental roles in the first phase of establishing GPNZ, will sell their shares to Gimv. Gimv and CEO Roman Wachtel are committed to a further capital contribution to the company.

Philipp v. Hammerstein, Partner at Gimv, comments: “We are very pleased with the development of the group since the start of our journey back in 2018. I wish to express my sincere thanks to Cannonball® and Marcus Geier for their invaluable contributions in establishing the company to where we stand today. We are excited about further prospects and committed to further supporting the team and developing the group going forward.”

Dominik F. Hesse, Managing Partner at Cannonball®, adds: “We are proud of having co-founded this success story and contributed significantly to building the company being both part of the management team and financial investor. It is now the right moment for us to hand over the baton. We would like to thank Gimv and the management team for this partnership and wish them all the best for the future development of GPNZ.”

Roman Wachtel, CEO of GPNZ sums up: “We are grateful for the further commitment, as well as the ongoing reliable support, deep sector knowledge and buy and build experience contributed by Gimv. We are looking forward to the future and remain fully committed to continue GPNZ’s successful path as a leading dental platform where patients experience the highest medical standards.”

This acquisition further underpins Gimv’s position as one of the most active European investors in the healthcare industry and its ambition to positively contribute to the United Nations Sustainable Development Goals of good health and well-being. Gimv currently has 23 participations in companies in the healthcare and life sciences sector. The Gimv portfolio also includes several clinic and practice groups, as well as medical technology and biotech companies.

No further financial details on this transaction are being published.

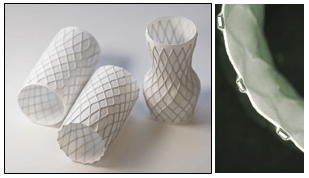

Implant designs for the fast-growing, transcatheter structural heart market primarily utilize a custom textile that is sutured to a high-performance Nitinol metal frame. Confluent’s Nitinol and biomedical textile expertise, in combination with Electrospinning’s leadership in electrospun nanofiber biomaterials expands the design options that Confluent customers can utilize in the structural heart market. Additionally, the application of the textile to the valve frame will be fully automated, simplifying the manufacturing process.

Implant designs for the fast-growing, transcatheter structural heart market primarily utilize a custom textile that is sutured to a high-performance Nitinol metal frame. Confluent’s Nitinol and biomedical textile expertise, in combination with Electrospinning’s leadership in electrospun nanofiber biomaterials expands the design options that Confluent customers can utilize in the structural heart market. Additionally, the application of the textile to the valve frame will be fully automated, simplifying the manufacturing process.