Investing in Petvisor

The Best-of-Breed in Vet Front-Office Software

Having tracked the pet and vet sector for several years, in late 2023, the Apax Digital Funds invested in Petvisor, a best-in-class veterinary and pet services business management and client engagement software platform. Petvisor’s integrated suite of branded solutions gives over 10,000 veterinary clinics and 400 grooming facilities the tools they need to engage their 20 million pet parent customers, streamline their clinic operations, grow their businesses, and ultimately recapture time to focus on what they love most – improving the health and wellness of pets.

Petvisor, like other successful vertical software companies, focuses on understanding the unique challenges of the veterinary industry. Petvisor addresses the specific needs of its veterinarians, vet techs, practice managers and other vet staff as well as their pet parent clients to drive higher customer retention rates and better pet-health compliance, reduce customer acquisition costs, and improve pet parent engagement through verticalization.

Apax Digital identified Petvisor as an opportunity for the Apax funds to invest in a differentiated business with potential to capitalize on the sector’s adoption of software solutions, building on Apax’s broader work in the vertical software space. Through this investment, the team will support Petvisor’s continued growth both organically and through M&A, working to advance its position as the go-to front-office platform for rapidly digitizing veterinary clinics.

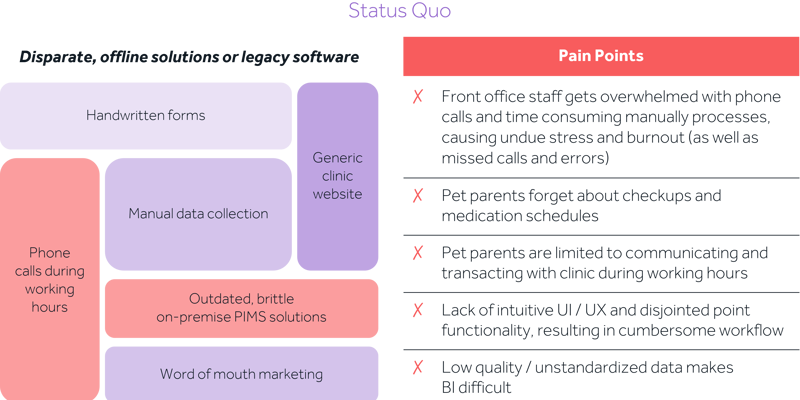

The Problem

Vet clinics face a number of challenges including trying to balance labor shortages – with up to 55,000 additional vets estimated to be needed by 20301, having to deal with overwhelming administrative requirements, whilst balancing the demands of increasing pet ownership and pet parent expectations. Simultaneously, clinic staff are under pressure to generate more revenue, foster pet parent engagement and loyalty, optimize workflows and have a comprehensive view of data across their clinics and corporate practices.

Despite this, clinics are forced to manage multiple forms of communication to interact with pet parents, often using outdated and disparate solutions that fail to work together. Some back-office practice information management system (PIMS) solutions have attempted to address this, but these often lack the ease of use and interoperability that many vet clinics and pet parents have come to expect from apps and software applications.

The Petvisor Solution

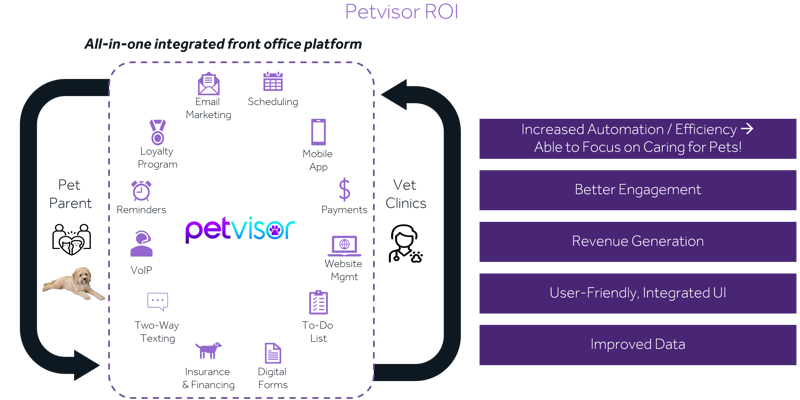

Petvisor offers a comprehensive, PIMS-agnostic integrated front-office platform that enables independent and corporate vet clinics to improve engagement with pet parents, drive revenue, and improve operations and efficiency. The platform integrates with 30+ PIMS that manage the back-office functionality for vet practices and extracts data to help inform the Petvisor offering.

Petvisor’s solution provides vet clinic customers with:

- Increased Revenue Generation: Clinics can increase the number of annual visits, reduce no-shows, increase pet parent retention, and ultimately, improve pet health compliance. The solution supports clinics’ efforts to drive revenue through attracting new clients, improving customer loyalty, and driving uptake of additional, higher-margin revenue streams such as insurance or pet food. On average, clinics see a 9% revenue increase in the first year using PetDesk (vs. typical 3% from price increases).

- Time and Cost Savings: A single platform to manage front-office efforts improves staff experience and reduces admin time by 12 hours per week on average.

- Improved Data: Enhanced reporting and insights on practice performance, marketing ROI and more sophisticated clinic operations so vets can better serve pets and their pet parents.

The History and Management Team

The Petvisor story began 11 years ago with the founding of PetDesk, and in 2020, Petvisor management and investors started building the company from a point solution to a comprehensive front-office platform. PetDesk became “Petvisor”, acquiring and integrating Vetstoria, WhiskerCloud, Kontak and Groomer.io into the platform. This transformation was supported by PetDesk founder Taylor Cavanah and later by Tim Callahan (CEO) and Ben Davis (CFO), who brought expertise in scaling software businesses and strategic M&A.

Today, Petvisor operates two brands, PetDesk in North America and Vetstoria in Europe. Both offer an extensive suite of Petvisor solutions that enhance client retention, facilitate revenue growth and alleviate administrative burdens on front office staff. We have partnered with Tim, Ben, Taylor and the management team at Petvisor to continue to drive forward the Petvisor solution with the aim of becoming a category-leading platform that enhances and extends the lives of pets around the globe.

Expanding Petvisor’s Reach, Scale and Impact in the Pet Ecosystem

Initially focused on veterinary services, Petvisor’s platform now includes groomers through the Groomer.io acquisition. The vision for the management team, Apax, and our investor partners Frontier and PeakSpan is to expand to additional vet clinic and pet parent offerings. Adjacent market opportunities for the future include AI transcription, wellness and pharmaceuticals. Given Petvisor’s traction in Europe through Vetstoria, international expansion is another key growth vector and M&A opportunity. Partnerships also remain central to Petvisor’s offering and position within the ecosystem, ensuring integration across back-office functionalities.

Other Apax partnerships in the pet and vet sector include Nulo (one of the fastest growing major pet food brands in the US), as well as vet hospitals Zoo Eretz and Chavat Daat.

If you are a founder or leader in the vet or pet space and are interested in a potential collaboration with Petvisor, we would welcome the opportunity to start a conversation. Connect with the Petvisor deal team at Apax mia.hegazy@apax.com and bettina.lu@apax.com.

Source:

1. Mars Health Research

.jpg?width=150&height=150&name=Untitled%20(150%20x%20150%20px).jpg)