Advent and Nextalia announce the signing of binding agreements for the acquisition of a stake in Tinexta from current majority shareholder Tecno Holding and the subsequent launch of a mandatory tender offer aimed at delisting

Upon completion, Advent and Nextalia will hold the majority of the shares of Tinexta while Tecno holding will retain a significant minority stake

Milan, 5 August 2025 – Advent International L.P. (“Advent”) acting on behalf of certain private equity funds managed and / or advised by it, and Nextalia SGR S.p.A. (“Nextalia”), acting on behalf of the Nextalia Private Equity and Nextalia Flexible Capital funds (together the “Sponsors”), announce the signing of binding agreements for the acquisition of a stake in Tinexta S.p.A. (“Tinexta” or the “Group”) from the current majority shareholder Tecno Holding S.p.A. (“Tecno Holding”).

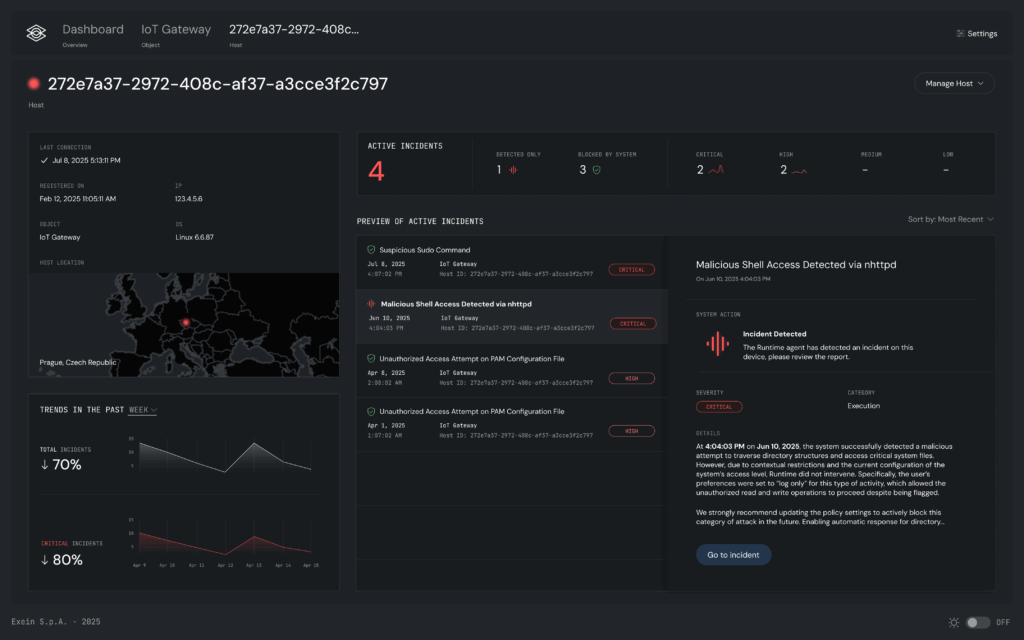

Tinexta is an Italian group with digital transformation at its core, operating across three divisions: Digital Trust, Cybersecurity, and Business Innovation. The Digital Trust division is a leading player in the Italian and European Digital Transaction Management market, enabling secure and trustworthy digital transactions between individuals and service providers as well as offering crucial digital tools for independent professionals. The Cybersecurity division offers a wide range of products and services within the Italian cybersecurity market. Lastly, the Business Innovation division supports SMEs and enterprises in innovation, sustainability, and internationalization processes through specialised advisory services.

Founded in 2009 and listed on the Euronext STAR Milan Segment since 2016, Tinexta has operations in 12 countries and over 3,000 employees. The Group has grown consistently over the past 15 years through a combination of organic growth and strategic M&A transactions, reaching total revenues in excess of €450 million in 2024.

As described in greater details in the press release available on Tinexta’s website, the transaction (the “Transaction”) entails the acquisition of a stake representing 38.74% of Tinexta share capital held by the current majority shareholder Tecno Holding by private funds managed by Advent and Nextalia (the “Acquisition”), and the launch, acting in concert with Tecno Holding, of a mandatory tender offer for Tinexta’s shares (the “Offer”), with the aim of delisting from the Euronext STAR Milan market, at the same price (€15 per-share) paid to Tecno Holding in the context of the Acquisition.

Completion of the Acquisition and launch of the Offer are subject to the approval of the Transaction by the shareholders’ meeting of Tecno Holding, convened for the 7th of August 2025, and to the receipt of all required legal authorisations.

Upon satisfaction of these conditions, the Sponsors will complete the Acquisition and proceed with the launch of the Offer, providing timely disclosures to the market.

Upon completion of the Transaction and assuming full success of the Offer, the Sponsors will hold the majority of Tinexta’s shares, while Tecno Holding will retain a significant minority stake.

Francesco Canzonieri, CEO of Nextalia, commented: “This transaction is transformational for Tinexta and represents a compelling opportunity to unlock significant value and accelerate growth in high-potential sectors. It allows us to position ourselves on an asset with the potential to become a consolidator and a key player in the Digital Transaction Management market. We aim to give the Group a clear strategic direction and long-term industrial imprint. Nextalia, thanks to its industrial and financial expertise and its extensive network of relationships, will support the Group in the effective execution of its business plan. This also confirms our ability to seize the most compelling opportunities in the Italian market, executing complex and impactful transactions in partnership with leading international investors.”

Francesco Casiraghi, Managing Director at Advent, commented: “Tinexta has a strong track record of innovation and is well-placed to become a European champion. Our investment in Tinexta reflects Advent’s commitment to backing leading growth-oriented businesses across Europe. Joining forces with Nextalia and Tecno Holding provides a unique opportunity to support the company’s next chapter, through enhancing its innovation capabilities, expanding internationally, and delivering long-term value. We look forward to working closely with the management team and our partners to accelerate Tinexta’s strategic development.”

Carluccio Sangalli, Chairman of Tecno Holding, commented: “We are proud to join forces with Advent and Nextalia, who represent the best partners to support Tinexta’s development in the years ahead, by contributing additional financial and industrial expertise. We believe that, also thanks to Advent and Nextalia’s global network and capabilities, Tinexta is ready to take a further step in its growth and market consolidation strategy, particularly abroad. We are also confident that the transaction will enhance the Group’s positioning as a hub for talent retention and an attractive platform for highly qualified professionals, delivering benefits for all of Tinexta’s stakeholders.”

Advent and Nextalia were assisted by Rothschild & Co, Mediobanca, Barclays, and Banca Akros / Gruppo Banco BPM as financial advisors, by Chiomenti and PedersoliGattai as legal advisors, Alvarez & Marsal for financial due diligence and by Legance and KPMG for tax and structuring matters. Tecno Holding has been advised by Lazard as exclusive financial advisor and by Gatti Pavesi Bianchi Ludovici as legal advisor.

About Advent

Advent International is a leading global private equity investor committed to working in partnership with management teams, entrepreneurs, and founders to help transform businesses. With 16 offices across five continents, we oversee more than USD $94 billion in assets under management* and have made over 430 investments across 44 countries.

Since our founding in 1984, we have developed specialist market expertise across our five core sectors: business & financial services, consumer, healthcare, industrial, and technology. This approach is bolstered by our deep sub-sector knowledge, which informs every aspect of our investment strategy, from sourcing opportunities to working in partnership with management to execute value creation plans. We bring hands-on operational expertise to enhance and accelerate businesses.

As one of the largest privately-owned partnerships, our 660+ colleagues leverage the full ecosystem of Advent’s global resources, including our Portfolio Support Group, insights provided by industry expert Operating Partners and Operations Advisors, as well as bespoke tools to support and guide our portfolio companies as they seek to achieve their strategic goals.

*Assets under management (AUM) as of March 31, 2025. AUM includes assets attributable to Advent advisory clients as well as employee and third-party co-investment vehicles.

About Nextalia

Nextalia SGR S.p.A. is an investment platform promoted by Francesco Canzonieri together with leading Italian institutional investors (Intesa Sanpaolo, Unipol Assicurazioni, Aurelia, Finprog Italia, Fondazione ENPAM, H14, Istituto Atesino di Sviluppo, Massimo Moratti S.a.p.a, Confindustria, Bonifiche Ferraresi and Micheli Associati.

With approximately two billion euros in assets under management, Nextalia has established itself as a key Italian player in private market investments, leveraging its extensive network and the expertise of a highly qualified team. Nextalia manages five funds, “Nextalia Private Equity”, “Nextalia Credit Opportunities”, “Nextalia Ventures”, “Nextalia Capitale Rilancio” and “Nextalia Flexible Capital” and has recently launched the fundraising phase for “Nextalia Credit Solutions”.

About Tecno

Tecno Holding S.p.Ais a financial company participated by Camere di Commercio, companies from the chamber system, and Unione Nazionale.

Media Contacts

Advent

Community

Giulia Polvara adventinternational@community.it

+39 334 2823514

Mafalda la Gala

mafalda.lagala@community.it

+39 347 74635

Nextalia

Marina Marchese

Gregorio Galimberti

IR@nextalia.com

MAIM Group

Andrea Pontecorvo

a.pontecorvo@maimgroup.com

+ 39 393 5486192