Champion Iron Limited (TSX: CIA) (ASX: CIA) (OTCQX: CIAFF) (“Champion” or the “Company”) today announced that it has entered into a transaction agreement (the “Transaction Agreement”) with Rana Gruber ASA (“Rana Gruber”), a leading Norwegian producer of high-grade iron ore, on terms of a conditional recommended voluntary cash tender offer to acquire all of the issued and outstanding shares of Rana Gruber at a price of NOK 79 (US$7.79) per share (the “Offer”), representing a total equity value of approximately NOK 2,930 million (US$289 million) (the “Transaction”). The Transaction is unanimously supported by Rana Gruber’s executive management and board of directors, and shareholders owning approximately 51% of Rana Gruber’s issued and outstanding shares have entered into separate pre-acceptance undertakings, whereby they have agreed, subject to the terms and conditions thereof, to tender their shares into the Offer. The Company expects to fund the Transaction through a combination of equity, debt, and cash on hand, including a US$100 million equity private placement (the “Private Placement”) with Caisse de dépôt et placement du Québec (“La Caisse”), a global investment group and long-standing financial partner of the Company, and a fully committed term loan in the amount of US$150 million (the “Term Loan”) solely underwritten by The Bank of Nova Scotia (“Scotiabank”).

For further details regarding this announcement, readers are referred to the joint voluntary cash tender offer announcement in respect of the Transaction (the “Announcement”) previously released in Norway on the date hereof in accordance with applicable Norwegian securities laws and which can be found under Rana Gruber’s profile on Euronext Oslo Børs’ electronic information system at https://newsweb.oslobors.no. This press release should be read in conjunction with, and is subject to, the full text of the Announcement.

Conference Calls and Webcasts Details

Champion will host two conference calls and webcasts to discuss the Transaction, which can be accessed from the Investors section of the Company’s website at www.championiron.com/investors/events-presentations or by dialing toll free +1-888-699-1199 within North America or +61-2-8017-1385 from Australia. Details regarding the online archive and replay numbers are available at the end of this press release.

- December 21, 2025, at 17:00 PM (Montréal time) / December 22, 2025, at 9:00 AM (Sydney time)

- December 22, 2025, at 9:30 AM (Montréal time) / December 23, 2025, at 1:30 AM (Sydney time)

Transaction Highlights

The Transaction positions Champion to capitalize on a number of strategic benefits, including:

- Long life of mine asset in a stable jurisdiction with access to renewable power;

- Proven iron ore producer with continuous production dating back to the 1960’s, recently producing at over 1.8 million tons per annum of high-grade iron ore, including a project to upgrade production to 65% Fe iron ore concentrate;

- Robust cash flow margins, supported by competitive all-in sustaining costs and proximity to customers;

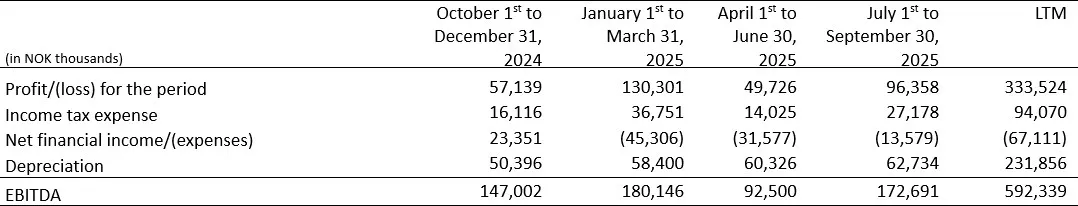

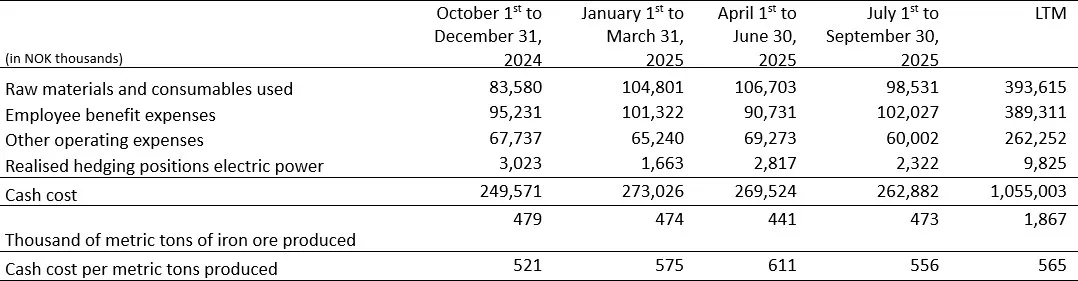

- History of generating robust cash flows, including trailing four quarter profit of NOK 333.5 million (US$32.9 million), EBITDA1 of NOK 592.3 million (US$58.4 million), and average cash cost per metric tons produced1 of NOK 565 (US$55.7);

- Expansion of Champion’s product portfolio, including different blends of high-grade iron ore concentrate and magnetite iron ore used in the chemical industry which attract premiums to the Platts IODEX 65% Fe CFR China index (“P65”);

- Creation of a larger and more diversified high-grade iron ore producer with opportunities to collaborate on sales logistics, including an established customer focus in Europe, further diversifying the Company’s sales mix;

- Expected near-term accretive impact per ordinary share of Champion’s revenue, EBITDA and cash flows from operating activities;

- Financial leverage ratios are expected to be maintained at closing near existing levels through the proposed financing structure;

- Aligned vision to service the green steel supply chain with Rana Gruber’s recent upgrade to 65% Fe iron ore concentrate and potential opportunities for additional grade improvements; and

- La Caisse’s strategic investment in this proposed acquisition underscores its continued commitment to the Company, while enabling the expansion and diversification of its asset base both within Québec and across international markets.

Champion’s CEO, Mr. David Cataford, said, “The proposed acquisition of Rana Gruber supports our vision to collaborate in decarbonizing the steel industry by leveraging Rana Gruber’s quality resources and proven iron ore operations. The Transaction offers an attractive value proposition for our shareholders, including an expected positive impact on our financial results, and strengthens Champion’s leadership in the global high-quality iron ore industry by diversifying our asset base and product portfolio. In our review of this opportunity and dialogue with Rana Gruber, we have identified several opportunities, including technical cooperation, customer engagement, and asset improvement potential. The larger entity created by this Transaction will enable Champion to continue considering organic growth projects and optimizing its capital return strategies. Through our collaboration with Rana Gruber’s management team, we intend to uphold our commitment to creating a positive impact for the local communities where we operate. We also thank our financial partners, including La Caisse and Scotiabank, for their continued support as we enter new markets, creating a global operating model to service the green steel supply chain.”

La Caisse’s Managing Director, Large Capitalizations, Québec, Mr. Jacques Marchand, said, “With this investment, La Caisse reaffirms its long-standing commitment to Champion, a recognized leader in high-quality iron ore mining operations and development. This acquisition strengthens the company’s position as a key player in the high-grade iron ore market — a critical mineral in steel decarbonization — while supporting its long-term growth ambitions. It’s also aligned with our strategy to foster the sustainable growth and global reach of companies firmly rooted in Québec.”

About Rana Gruber

Rana Gruber is a Norwegian iron ore producer based in Mo i Rana, Nordland, with the owned properties benefiting from an heritage tracing back over 200 years of mining expertise. Rana Gruber was established in 1964 and listed on the Oslo stock exchange in 2021. Rana Gruber’s current mining operations draw from an underground operation and nearby open pits, and benefits from an extensive resource base to potentially maintain current production levels for decades. The mining area is connected by a common carrier railway approximately 35 kilometres from its coastal processing plant, which has direct access to its dedicated port facility. Rana Gruber extracts and processes natural mineral resources to produce different types of iron ore concentrate. Accordingly, the company produces two different hematite iron ore concentrates, including a recent upgrade to 65% Fe quality, intended primarily for steel production with customers focused in Europe. Additionally, Rana Gruber produces a magnetite iron ore concentrate, a high purity iron-oxide product that finds use in sectors outside traditional metallurgy, such as water purification and industrial chemical applications focused in Europe, and has attracted a premium to the P65 index through time. With its access to renewable power, the company benefits from one of the lowest carbon emissions per ton of iron ore concentrate in the global industry.

As at September 30, 2025, Rana Gruber had current lease liabilities of NOK 95.4 million (US$9.4 million) and non-current lease liabilities of NOK 189.3 million (US$18.7 million). Apart from leases liabilities, Rana Gruber had no long-term debt. Rana Gruber has a credit facility of NOK 100 million (US$9.9 million), which was unused as at September 30, 2025. As at September 30, 2025, Rana Gruber’s cash and cash equivalents totalled NOK 24.7 million (US$2.4 million).

Financing Details

As at September 30, 2025, Champion held a cash balance of C$325.5 million, excluding the restricted cash account held by the Kami Iron Mine Partnership, and had access to undrawn amounts under its senior revolving credit facility of C$514.9 million. The Company expects to fund the purchase price for the Transaction, estimated at US$289 million (C$399 million), and the related fees and expenses, through a combination of the proceeds of an equity private placement with La Caisse, a new committed secured term loan facility, and cash on hand. All of the above elements of the Transaction financing plan have been designed and structured with a view to maintaining financial leverage ratios at closing near existing levels.

Private Placement

The Private Placement is to be completed by way of an issue of subscription receipts on a prospectus-exempt and non-brokered basis, with each subscription receipt representing the right to receive one ordinary share of Champion upon and conditional on the successful completion of the Transaction. The issue price of C$5.1508 per ordinary share for the Private Placement represents a discount of 3.5% to the trailing 20 trading days volume-weighted average trading price (VWAP) of the ordinary shares on the Toronto Stock Exchange (the “TSX”) prior to the date of the announcement. Assuming closing of the Transaction and assuming no change in the number of ordinary shares issued and outstanding until closing of the Transaction, the Private Placement represents ordinary share dilution to Champion of approximately 5.0%, and La Caisse would hold approximately 8.5% of Champion’s ordinary shares, in each case on a non-diluted basis.

The gross proceeds of the Private Placement will be deposited in escrow, to be released to Champion following announcement that the minimum acceptance condition of the Offer has been met, provided the other conditions for completion of the Offer, as set out in the Transaction Agreement, are satisfied and are expected to remain satisfied at the time of closing of the Transaction. La Caisse will also receive upon conversion of the subscription receipts for shares, a customary capital commitment fee and an amount equal to any dividends declared by Champion and payable to holders of ordinary shares of record as of dates from and including the closing date of the Private Placement to but excluding the date of the conversion of subscription receipts into shares. Should the conditions referred to above not have been satisfied by May 16, 2026, or the Offer lapse, terminate or be revoked or withdrawn, the gross proceeds of the Private Placement will be returned to La Caisse with interest actually earned thereon.

The issuance of the subscription receipts remains subject to the approval of the TSX and Australia Securities Exchange (“ASX”). Closing of the private placement is expected to occur in the first quarter of the 2026 calendar year, subject to the satisfaction of customary closing conditions, including applicable regulatory approvals.

New Term Loan Facility

Scotiabank, acting as sole underwriter, sole arranger and sole bookrunner, provided a binding commitment for the Term Loan consisting of a US$150 million senior secured non-revolving credit facility, which shall be available by way of a single draw on and subject to closing of the Transaction.

Upon completion and execution of the final loan documentation and closing of the Transaction, the Term Loan will have a maturity of four years and is expected to bear the same interest rate as the Company’s existing senior revolving credit facility. The Term Loan principal amount will be repaid at a pace of 2.5% quarterly, after a grace period of two quarters post closing of the Transaction, with the remaining balance to be repaid at maturity.

Transaction Timeline and Other Considerations

The Transaction will be implemented pursuant to the Offer. Rana Gruber’s shareholders will be offered NOK 79 (US$7.79) per share in cash, representing a total equity value of approximately NOK 2,930 million (US$289 million) based on the number of issued and outstanding shares as at the date of the Announcement.

The Offer will be subject to customary launch and closing conditions, including but not limited to, the Offer being accepted to such extent that Champion (indirectly through a wholly-owned subsidiary) becomes the owner of shares representing more than 90% of the shares and voting rights in Rana Gruber. If, as a result of the Offer or otherwise, Champion acquires and holds (indirectly through a wholly-owned subsidiary) 90% or more of all issued and outstanding shares and voting rights of Rana Gruber, then it will have the right, and intends to, carry out a compulsory acquisition (squeeze-out) of the remaining shares. The complete details of the Offer, including all terms and conditions thereof, will be included in an offer document for the Offer (the “Offer Document”) to be sent to Rana Gruber’s shareholders following review and approval by the Financial Supervisory Authority of Norway (the “NFSA”) pursuant to Chapter 6 of the Norwegian Securities Trading Act. The Offer Document is expected to be approved by the NFSA in time for the offer period to commence towards the end of January 2026. The Offer may only be accepted on the basis of the Offer Document.

In accordance with Norwegian securities laws, the Offer is expected to initially be opened for acceptance by Rana Gruber shareholders for a period of four weeks following launch of offer period. Subject to the approval of the NFSA, Champion may, at its discretion, extend the acceptance period one or more times. Barring unforeseen circumstances or extensions of the acceptance period of the Offer, it is currently expected that if successful, the Offer will be completed in the second quarter of the 2026 calendar year, assuming the prior satisfaction or waiver of all conditions for the Offer.

Subject to such considerations, the Transaction is expected to close in the second quarter of the 2026 calendar year. Post closing of the Transaction, senior management of Rana Gruber are expected to remain as leadership of Champion’s Norwegian subsidiary, including the company’s CEO, Mr. Gunnar Moe, who has led the company for several years.

Pre-Acceptance Undertakings; Rana Gruber Board Recommendation

In connection with the Offer, Mirabella Financial Services LLP, on behalf of Svelland Global Trading Master Fund and certain other accounts, multiple large shareholders and all members of the board of directors and the executive management of Rana Gruber, who own approximately 51% of the issued and outstanding shares of Rana Gruber as at the date of the Announcement, have entered into separate pre-acceptance undertakings, whereby they have agreed subject to the terms and conditions thereof to tender their shares into the Offer.

Rana Gruber has agreed to customary non-solicit covenants, including not to, directly or indirectly, solicit alternative offers for the shares or Rana Gruber’s assets or otherwise take any action that may prejudice, impede, delay or frustrate the Offer. The Transaction Agreement includes a customary right to match any superior competing proposal in favor of the Company.

The board of directors of Rana Gruber has also unanimously resolved to recommend the Rana Gruber shareholders to accept the Offer.

Financial and Legal Advisors

Advokatfirmaet BAHR AS, Stikeman Elliott LLP, Ashurst LLP and McCarthy Tetrault LLP are acting as legal advisors to Champion, while Clarksons Securities AS is acting as its financial advisor. Wikborg Rein Advokatfirma AS is acting as legal advisor for Rana Gruber, while DNB Carnegie, a part of DNB Bank ASA, is acting as its financial advisor. Fasken Martineau DuMoulin LLP and Clayton Utz are acting as legal advisors to La Caisse.

Conference Calls and Webcasts Online Archive and Replay

- First event will be on December 21, 2025, at 17:00 PM (Montréal time) / December 22, 2025, at 9:00 AM (Sydney time)

- Second event will be on December 22, 2025, at 9:30 AM (Montréal time) / December 23, 2025, at 1:30 AM (Sydney time)

An online archive of the webcast will be available by accessing the Company’s website at www.championiron.com/investors/events-presentations. A telephone replay will be available for one week after the call by dialing +1-888-660-6345 within North America or +1-289-819-1450 overseas, and entering passcode 10256# for the First Event and 67944# for the Second Event.

About Champion Iron Limited

Champion, through its wholly-owned subsidiary Quebec Iron Ore Inc., owns and operates the Bloom Lake Mining Complex located on the south end of the Labrador Trough, approximately 13 kilometres north of Fermont, Québec. Bloom Lake is an open-pit operation with two concentration plants that primarily source energy from renewable hydroelectric power, having a combined nameplate capacity of 15M wet metric tonnes per year that produce lower contaminant high-grade 66.2% Fe iron ore concentrate with a proven ability to produce a 67.5% Fe direct reduction quality iron ore concentrate. Benefiting from one of the highest purity resources globally, Champion is investing to upgrade half of the Bloom Lake’s mine capacity to a direct reduction quality pellet feed iron ore with up to 69% Fe. Bloom Lake’s high-grade and lower contaminant iron ore products have attracted a premium to the P62 index. Champion ships iron ore concentrate from Bloom Lake by rail, to a ship loading port in Sept-Îles, Québec, and has delivered its iron ore concentrate globally, including in China, Japan, the Middle East, Europe, South Korea, India and Canada. In addition to Bloom Lake, Champion holds a 51% equity interest in Kami Iron Mine Partnership, an entity also owned by Nippon Steel Corporation and Sojitz Corporation, which owns the Kami Project. The Kami Project is located near available infrastructure, only 21 kilometres southeast of Bloom Lake. Champion also owns a portfolio of exploration and development projects in the Labrador Trough, including the Cluster II portfolio of properties, located within 60 kilometres south of Bloom Lake.

For further information, please contact:

Champion Iron Limited

Michael Marcotte, CFA

Senior Vice-President, Corporate Development and Capital Markets

+1-514-316-4858, Ext. 1128

info@championiron.com

For additional information on Champion Iron Limited, please visit our website at: www.championiron.com.

This press release has been authorized for release to the market by the board of directors of Champion Iron Limited.